Chris Hanley, CA, CPA, CFP® and Denika Heaton, BBA, JD, TEP

Mawer Tax and Estate Planning Specialists

Transferring the family cottage is more than just a financial and legal decision—it’s a deeply personal one that can impact your family's dynamic for generations. The process involves a careful balance of emotional considerations and practical planning.

In the final two articles of our cottage succession planning series, we’ll guide you through several key financial, legal, and personal considerations to help ensure the transfer process runs smoothly—and that family relationships can remain intact throughout.

Please note the following suggestions are general in nature. This type of planning involves nuanced tax and legal considerations, so it’s best to consult with your legal counsel for personal guidance.

Having the Family Dialogue

In our first article, we highlighted the importance of bringing everyone together to not only to discuss your wishes around the property, but also confirm if your children really want ownership of it—and if they can truly manage and share those responsibilities.

These discussions can be challenging and might require help from estate planning professionals or a formal family meeting. While difficult, it’s a crucial step to take: addressing these matters before planning the transfer can help prevent potential conflicts or litigation. Usually this step will take time; multiple, frank discussions with family members; and sometimes may even lead to the conclusion that selling is the preferred option.

Deciding When is Best to Transfer the Cottage

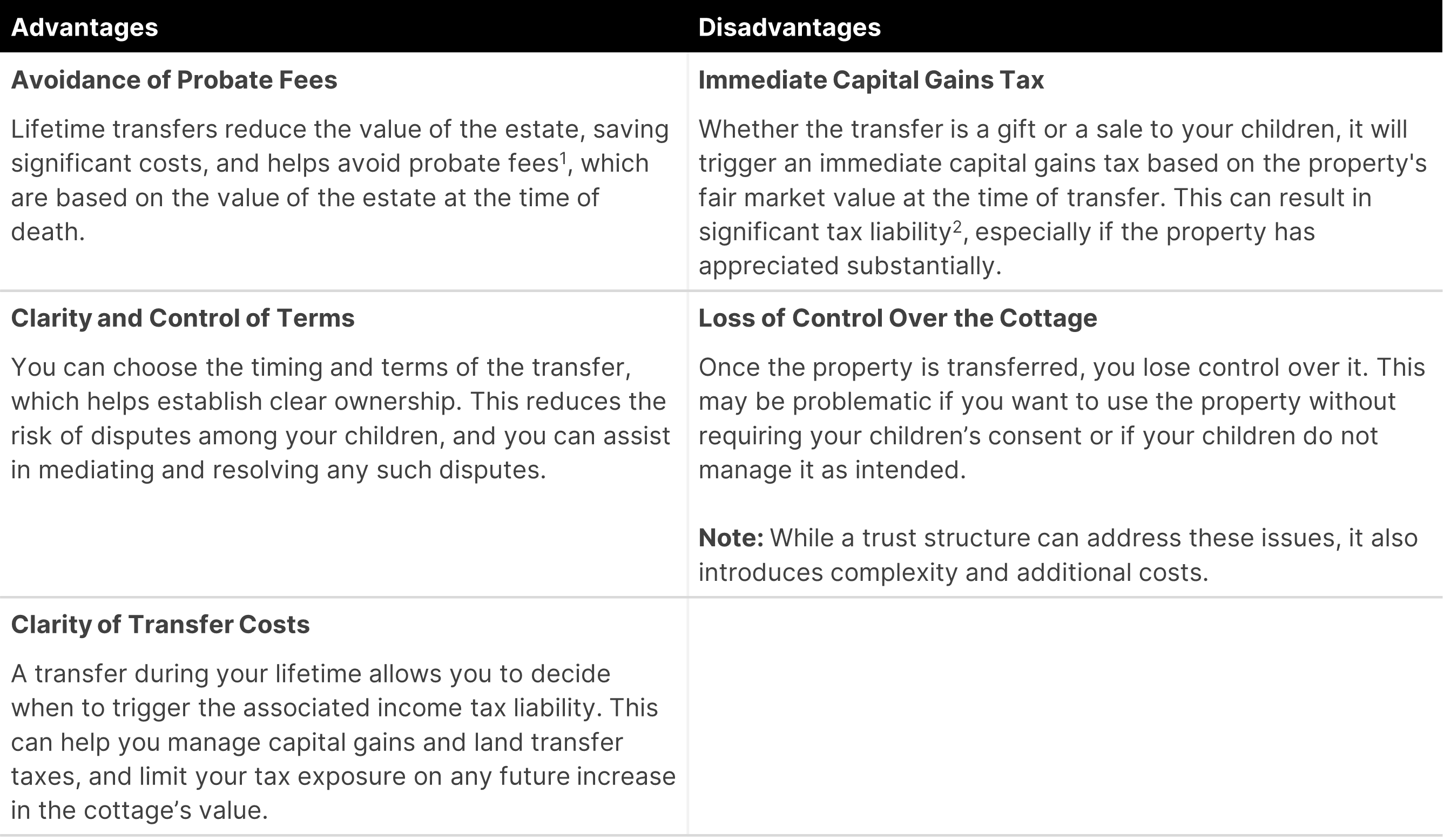

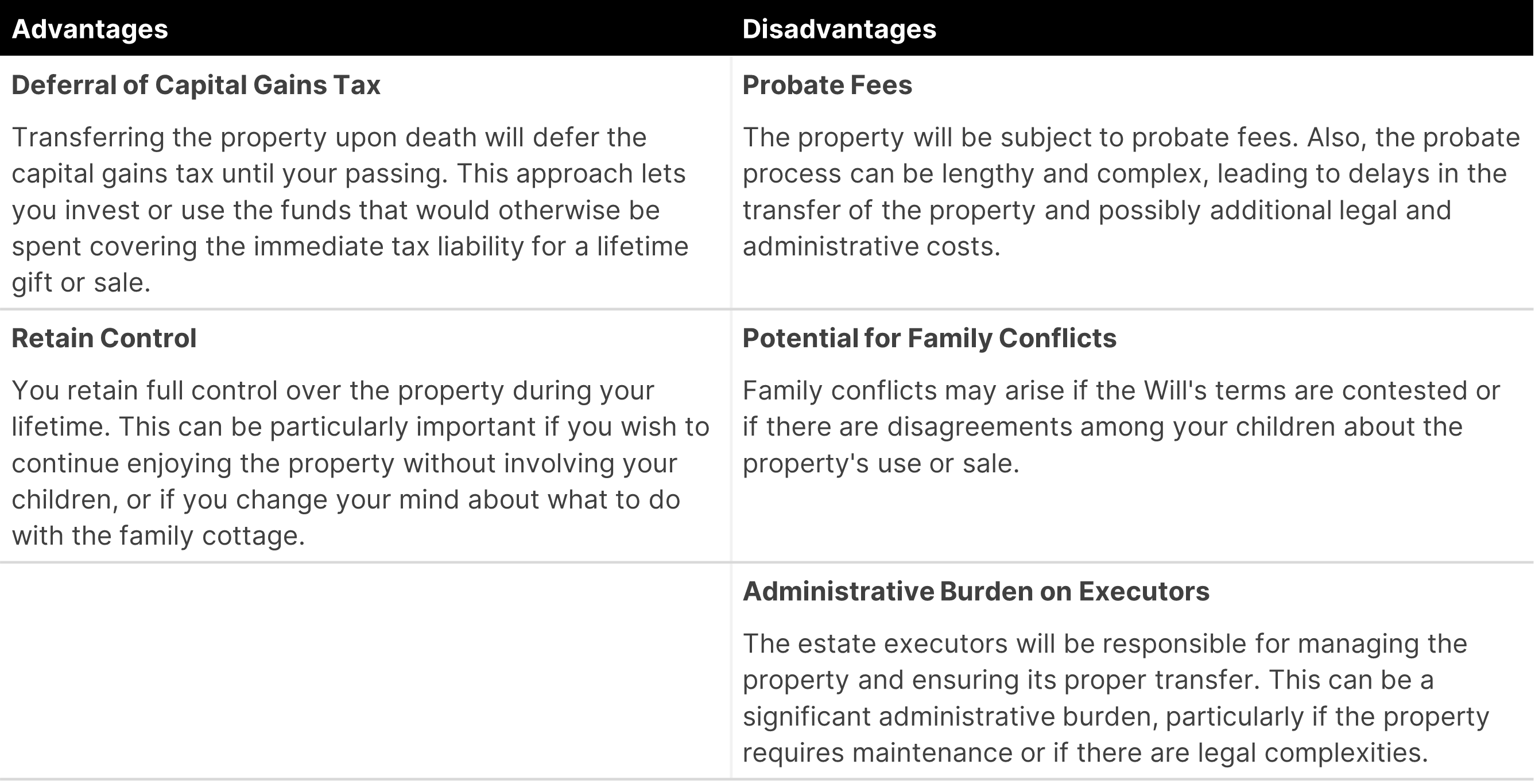

If you have decided the family cottage will remain in the family, then timing is one of the most important decisions you'll face. Namely, should you transfer the property during your lifetime, or let it be part of your estate plan?

Each option has its own set of advantages and challenges, and the best choice depends on your unique situation.