Beginning the Family Dialogue

Bring Everyone to the Table

It’s crucial to make time for discussions that are open, honest, and include everyone—from those involved in the decision making to those who will be impacted. For instance, if you are thinking of transferring cottage ownership to some but not all your adult children, it’s worth organizing a family meeting to share your reasons for that choice and include all of them, as this can help reduce discord and litigation risk later.

Decide on Terms

Successful cottage succession planning conversations also need to incorporate a frank assessment of who really wants the property and realistically has the time and funds to maintain it.

It’s worth getting into the practical details. For example, access and proximity: who lives close by and has flexibility to visit? Will each of your children intend to use the cottage proportionally now and in the future? If there are substantial usage discrepancies between parties, you’ll need to make plans for how to help maintain fairness. Even clarifying when each family member can access the cottage may be necessary, as problems will ensue if everyone wants to visit during peak summer months.

How to prioritize property repairs, capital improvements, and what happens if one child wishes or needs to sell are also factors that need to be considered and accounted for in these discussions.

Be Open to the Alternative

Sometimes, the best decision is to sell rather than have a place of cherished memories transform into a source of contention, discord, or even litigation between your family members. While it may be hard to come to this conclusion, in our experience, it’s worth being open to this possibility.

Choosing the Transfer Structure

As every family comes with its own unique dynamics, there isn’t a one-size-fits-all approach when it comes to formalizing the transfer process. The number of children you plan to transfer the cottage to, their relationship with each other and their respective spouses, and where they all live (and plan to live in the future) can all impact your choice of ownership structure. To start, it’s important to:

Decide on Timing

One of your first steps is to consider when you want this transfer to occur—either during your lifetime or upon your passing—and if you want this to be a gift or a sale to your adult children. Two common ways to hold legal title to the family cottage include the children holding it jointly (whether as tenants in common or with rights of survivorship) or the cottage being held in a trust.

Review Joint Ownership Options

With joint ownership, a cottage co-ownership agreement should be executed among all owners. This agreement can help govern what happens if one child wants out (it may include a right of first refusal), how expenses are shared (including what happens if one child fails to pay their allocated expenses), how improvements are decided upon, and what happens if a child passes. For example, does their share go to the surviving spouse (if applicable) or stay within the family? Keeping in mind there are major matrimonial considerations, and each province is different.

Consider a Trust

A trust may help minimize animosity and friction among the beneficiaries, but it often comes with additional costs. These include costs to create the trust and annual costs to maintain the trust. If the family cottage is to be held for several decades, the cottage held by the trust would be deemed to have a taxable disposition every 21 years, which could generate a large tax liability with no matching influx of funds to cover it.

Lastly, other considerations like the applicability of the Underused Housing Tax Act or any local vacancy levies could impact the ownership structure. Furthermore, cottage properties located outside of Canada make the choice of ownership structure even more complicated.

Navigating Tax Considerations

Many cottages have seen dramatic increases in value over the years. Depending on your income, province of residence, and the length of ownership, the capital gain on your property could lead to a substantial income tax bill.

While you may transfer assets to your spouse tax-free during your lifetime or on death, a transfer to your children or other family members will trigger a capital gains tax that must be paid. A gift of the property will still trigger the full capital gains taxes, as would a sale at less than fair market value. Additionally, probate taxes (or fees) and land transfer taxes and costs must also be considered.

Establish Your Adjusted Cost Base

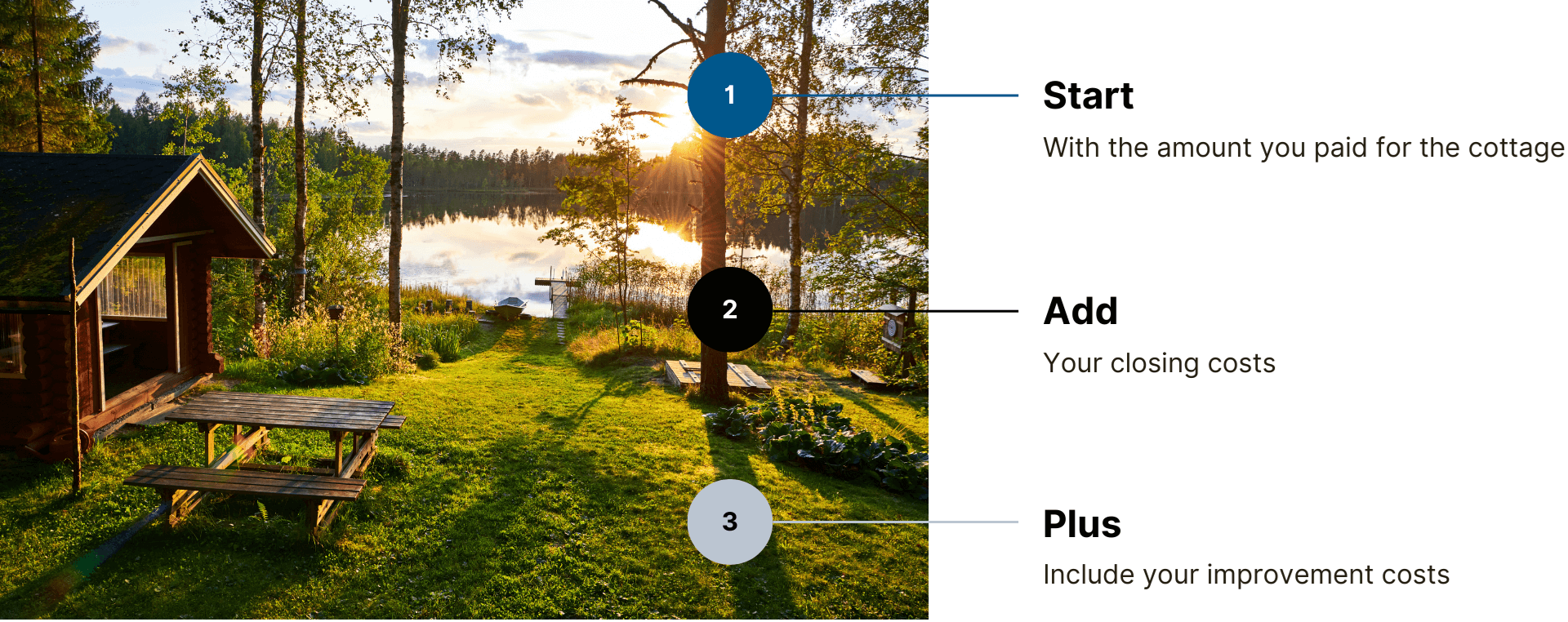

Capital gains on the sale or gifting of a property are calculated by subtracting the adjusted cost base (“ACB”) from the proceeds of sale (or deemed proceeds of sale at current market value, in the case of a gift or upon death). The larger the ACB, the smaller the capital gains.