Stu Morrow, CFA | Mawer Investment Counsellor

Just as some people feel dizzy looking down from a skyscraper or freeze at the edge of a cliff, many investors experience unease when markets reach new heights. This fear of investing at market peaks often leads to paralysis, causing investors to miss out on potential gains while fixating on possible downsides.

Understanding Market Peak Psychology

Our natural aversion to loss makes investing at market highs particularly challenging. Like imagining the worst when peering over a ledge, investors often picture an imminent market crash when stocks reach new peaks. This fear, combined with the illusion that we can time the market perfectly, can lead to missed opportunities and suboptimal investment decisions.

The Reality of Market Peaks

Historical Performance After Market Peaks

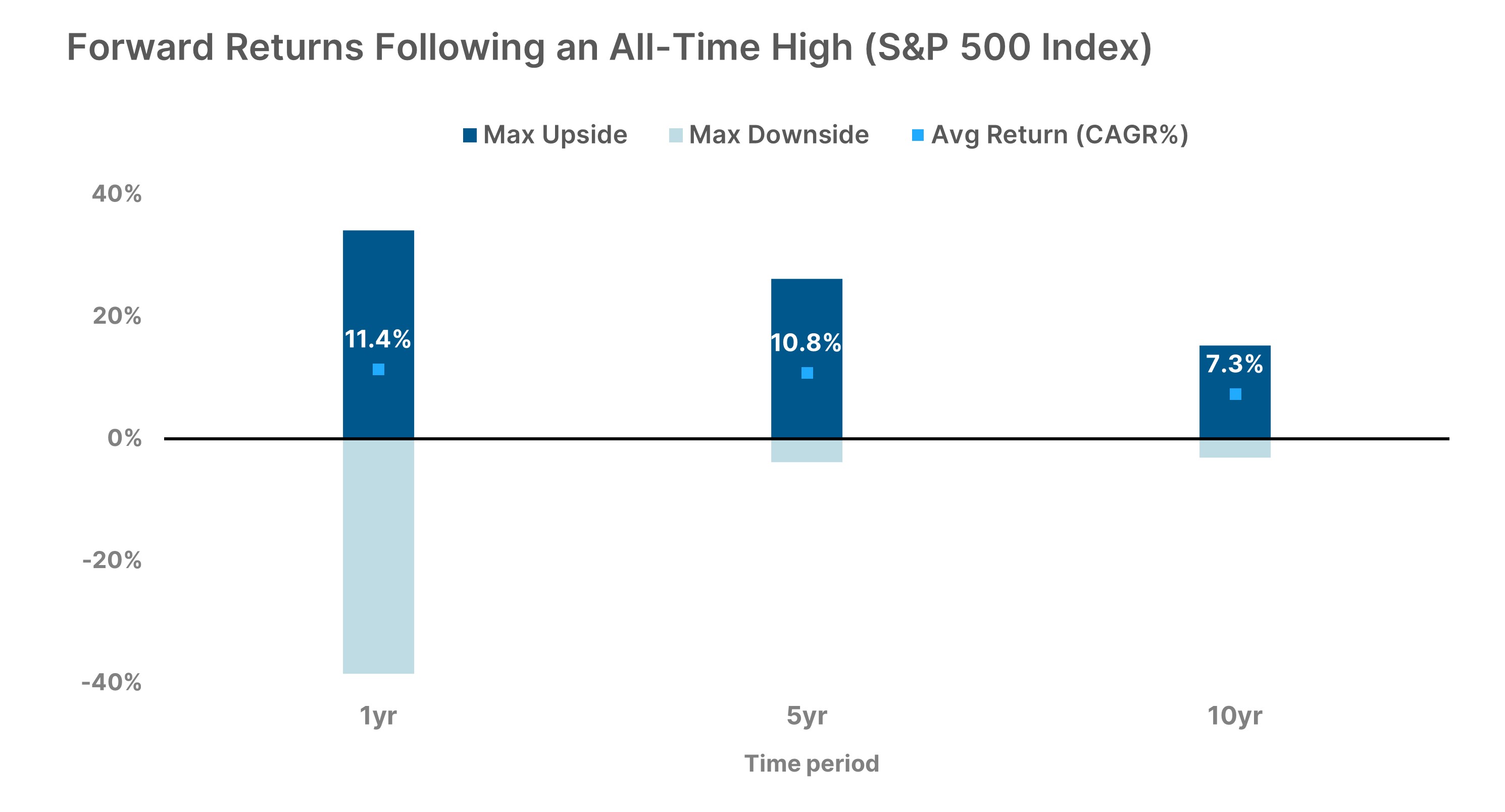

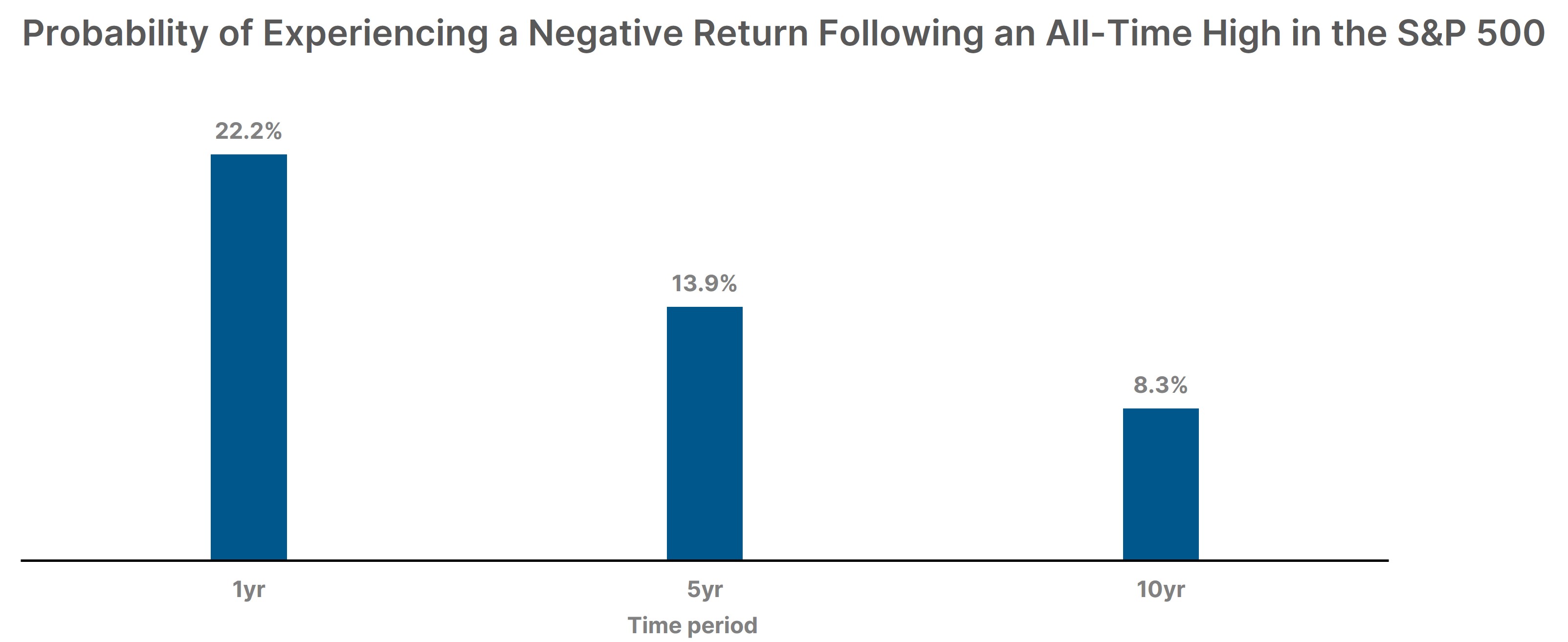

Historical data tells a different story than what our fears might suggest. Consider these insights:

The S&P 500 Index has reached 57 all-time highs in the past year alone—above the long-term median, but not unprecedented. Since 1950, approximately 6.7% of trading days have seen the market at record levels.

Looking at returns following market peaks reveals an encouraging pattern. See the analysis of the S&P 500 Index since 1989 in the first chart, which shows that investing at market highs can still lead to solid returns over time.