Lifetime Capital Gains Exemption (“LCGE”)

This Budget proposes to increase the LCGE limit to $1,250,000, from the current level of $1,016,836. The new proposed limit would be indexed to inflation from 2026 onwards.

The LCGE provides individuals with tax savings on the capital gains realized, either by sale or upon death, of shares of a qualified small business corporation (an active business in Canada meeting certain conditions) or qualified farm or fishing property.

This measure would be applicable to dispositions on or after June 25, 2024.

Canadian Entrepreneurs’ Incentive ("CEI")

The Budget introduces a new incentive for entrepreneurs, which will reduce the capital gains inclusion rate on capital gains by 50% for certain share dispositions if conditions are met. As the budget also proposes a 66.67%, inclusion rate for capital gains, then the CEI measure would result in a capital gain inclusion rate of 33.33%.

There will be a lifetime limit for the CEI of $2 million, to be phased in by annual increments of $200,000 per year, from 2025 through 2034. For example, an individual entrepreneur meeting all conditions and having a sale in 2027 would have a CEI limit of $600,000.

This measure will provide significant tax savings to those that are able to meet the criteria, especially for dispositions later in the phase-in period. The CEI ($2 million once phased-in) can also be combined or stacked with the LCGE discussed above ($1,250,000), providing favourable taxation on a total of $3,250,000 of gains.

To benefit from the CEI, criteria include similar holding-period and asset-threshold requirements as the existing LCGE rules, as well as all of the additional criteria unique to the CEI:

- The individual must own the shares directly for five years;

- The shares must represent more than 10% of the corporation's market value and voting rights;

- The individual must be actively involved in the business throughout the five years; and

- The shares must have been obtained for fair market value consideration.

There are notable types of businesses that will not qualify for the CEI:

- A direct or indirect interest in a professional corporation;

- A corporation whose principal asset is the reputation or skill of one or more employees; or

- Businesses operating in certain industries including financial, insurance, real estate, food, accommodation, arts, recreation, entertainment, consulting and personal care.

Guidance is not yet available on how to interpret the conditions; for example, how to determine if a business falls into one of the excluded types.

Employee Ownership Trusts ("EOTs")

Budget 2024 provides further clarity around EOTs, which are structures originally proposed in Budget 2023 and currently with draft legislation before Parliament. As announced in the 2023 Fall Economic Statement, EOTs are proposed to exempt $10 million of capital gains on the sale of a business to an EOT, subject to certain conditions.

Budget 2024 introduces a very lengthy set of conditions to qualify for the $10 million exemption, including level of activity in the business, Canadian residency of the beneficiaries, the use of business assets and choice of trustees, among other restrictions—along with disqualifying criteria, including a possible retroactive denial of the tax exemption. All of these onerous conditions combine to make EOTs a higher commercial risk when business owners are looking at options to sell their business.

These proposals will apply to transactions occurring between January 1, 2024 and December 31, 2026.

Expanded CRA Powers

The Budget provides for expanded CRA powers, purportedly to increase the efficiency and effectiveness of tax audits and collections, but it also applies more generally. These changes include information gathering tools, new rules to prevent tax-debt avoidance, more penalties and stronger enforcement abilities. These changes are also being proposed for other tax statutes administered by the CRA, including the Excise Tax Act, as an example. Some key CRA expanded powers are discussed below.

Compliance Orders and Notice of Non-Compliance

The Budget proposes new penalties for non-compliance equal to 10% of tax payable (if the tax owing exceeds $50,000 for a tax year) to be levied against a taxpayer who fails to comply with compliance orders issued by the Federal Court to disclose information or documents to the CRA. This is in addition to the existing powers of the Federal Court to hold taxpayers in contempt of Court for failure to comply with CRA demands for information.

This Budget further proposes to give the CRA new powers to issue a new separate type of notice: a “notice of non-compliance” to those who fail to comply with CRA demands for assistance or information. Failure to comply can result in daily penalties of $50 per day, up to a maximum of $25,000. These notices can be issued to any person, including a taxpayer's accountant. Additionally, it is proposed that a notice of non-compliance prevents taxation years from becoming statute-barred for the taxpayer and any non-arm’s length parties.

Questioning Under Oath

The Budget also proposes expanded investigative powers to permit the CRA to demand information from any person, including a taxpayer's accountant, orally under oath, or by sworn affidavit. This is analogous to the powers of other administrative bodies to compel sworn statements, such as Securities Commissions. This means taxpayers may need to engage legal counsel to gain the protection of solicitor-client privilege on their tax matter(s), which privilege is not available to accountants and other advisors.

Avoidance of Tax Debts

Another of these measures is aimed at improving the existing rule on tax-debt avoidance. This proposed penalty would be applicable for engaging in section 160 avoidance planning, which is when a property has been transferred from a tax debtor to another person, and in the same transaction or series of transactions, there’s been a separate transfer of property from a person other than the tax debtor to a transferee that does not deal at arm’s length with the original tax debtor. One of the objectives of tax-debt avoidance is to evade joint and several, or solidary, liability for that tax debt, i.e., aiming to render all or a portion of a current or future tax-liability debt of the taxpayer uncollectible.

The proposed penalty, for those who engage in, participate in, or knowingly support section 160 avoidance planning, is the lesser of 50% of the liability sought to be avoided or the sum of $100,000 and the person’s gross entitlements at the time the notice of assessment of the penalty is sent. The penalty does not apply to a person solely because they provided clerical or secretarial services with respect to section 160 avoidance planning. The proposed amendments will apply to transactions that occur on or after Budget Date.

The above amendments would come into effect upon passing of the enacting legislation.

3.87 Million New Homes By 2031

In attempts to address the national affordability crisis, the Federal Government aims to rapidly increase housing affordability and supply through a multitude of measures aimed predominately at first-time homebuyers and renters, which include both tax and non-tax initiatives. Some of these non-tax measures include: increasing the annual limit for Canada Mortgage Bonds, incentivizing municipalities to make drastic zoning changes, and launching a new Canada Housing Infrastructure Fund. The Budget further proposes the new Public Lands for Homes Plan to build homes on repurposed public lands, such as postal offices and National Defence land, which includes unlocking federal properties to be leased to builders—for instance, building nearly 100 homes at Currie in Calgary, Alberta.

Other initiatives involve funding for new technology for innovative ways to build more homes faster, such as upscaling of modular homes, the use of 3D printing and apprenticeship funding to train those needed to build these homes. In addition, there are also proposals for funding to recognize foreign credentials in the construction industry. The Budget also aims to implement a new Canada Secondary Suite Loan Program, which would allow homeowners access to $40,000 in low-interest loans to add secondary suites.

For first-time buyers of new builds, the Budget proposes access to 30-year mortgage amortizations, thereby lowering first-time buyers’ mortgage payments. The Budget is also enhancing the Home Buyers’ Plan (“HBP”) by increasing the withdrawal limit from $35,000 to $60,000. This means that after the Budget Date, an additional $25,000 could be withdrawn from RRSPs as part of the HBP’s increased limit, which can also be withdrawn for the benefit of a disabled individual. Amounts withdrawn under the HBP must be repaid to the taxpayer’s RRSP over 15 years. However, for HBP withdrawals made from RRSPs between January 1, 2022, and December 31, 2025, the 15-year period will be deferred by an additional three years. We query whether these first-time home buyer initiatives will have the opposite effect and instead add fuel to the already hot housing market and make residential real estate less affordable for Canadians.

For renters, the Budget proposes a new Tenant Protection Fund to provide funding to tenants’ advocacy groups, as well as implementing a new Canadian Renters’ Bill of Rights, to be developed in conjunction with the provinces and territories.

In advance of this Budget, in February of this year, the Federal Government announced that it intends to extend the ban, facilitated by the Purchase of Residential Property by Non-Canadians Act, on foreign investment in Canadian homes by an additional two years, to January 1, 2027. Furthermore, this Budget announces that the Federal Government will launch consultations on a new tax aimed at residentially zoned vacant land. If enacted, the aim of this would be to encourage the development of unused land for housing, thereby increasing the supply of homes. The Federal Government plans to consult on this proposal later in the year. This is in addition to the previously announced (from the 2021 Federal Budget) 1% vacancy tax on underused residential properties owned by nonresident, non-Canadians.

Purpose-Built Rental Housing

To provide incentives for businesses to address the housing crisis, the Budget proposes two key measures: accelerated Capital Cost Allowance and Interest Deductibility Limits

Accelerated Capital Cost Allowance (“CCA”)

This Budget proposes a temporary, accelerated tax depreciation, CCA, at 10% for eligible, purpose-built rental projects. These projects must commence construction after April 15, 2024, and before January 1, 2031, and must be available for use before January 1, 2036.

This measure aims to incentivize the construction of rental housing that meets specific criteria, including:

- Having a minimum of four private apartment units, or 10 private rooms or suites; and

- Holding at least 90% of residential units for long-term rental.

The accelerated CCA will not apply to renovations of existing residences. New additions to an existing structure will be eligible, and projects converting existing, non-residential real estate into a residential complex will also qualify. The Accelerated Investment Incentive, which suspends the half-year rule, will remain applicable to eligible property put in use before 2028.

Interest Deductibility Limits

The Budget proposes to exempt certain interest and financing costs from rules that might otherwise limit their deductibility. The excessive interest and financing expenses limitation (or “EIFEL”) rules are currently before Parliament and would limit the deduction of these expenses once enacted. The exemption from the EIFEL rules for a residential project is available for interest and financing expenses incurred before January 1, 2036, and eligibility is based on the same criteria as the accelerated CCA above, namely:

- Having a minimum of four private apartment units, or 10 private rooms or suites; and

- Holding at least 90% of residential units for long-term rental.

This measure will apply to taxation years beginning on or after October 1, 2023, consistent with the EIFEL rules.

Clean Energy Incentives

This year’s Budget introduces a suite of clean energy incentives aimed at accelerating Canada's transition to a low-carbon economy. These initiatives are designed to promote the adoption and development of clean energy technologies through a variety of tax incentives and regulatory changes. Some of these Clean Energy Incentives are:

- Electric Vehicle Supply Chain Investment Tax Credit

- Canada Carbon Rebate for Small Businesses

- The Clean Electricity Investment Tax Credit

Electric Vehicle Supply Chain Investment Tax Credit

The Budget introduces more tax incentives for investing in clean technologies and expands eligibility of previous tax incentives in this area. Some of these include a 10% Electric Vehicle Supply Chain Investment Tax Credit on the cost of buildings used in crucial segments of the electric vehicle supply chain across three supply chain segments: electric vehicle assembly, electric vehicle battery production, and cathode active material production.

Canada Carbon Rebate for Small Businesses

The Canada Carbon Rebate, which is an automatic refundable tax credit for CCPCs with no more than 499 employees in Canada, was introduced in this year’s Budget. This rebate is applicable to CCPCs with employees located in provinces that participate in the federal backstop pollution-pricing fuel charge, commonly known as the federal carbon tax. The government will announce the payment rate for each province for each fuel charge year. That payment rate will then be multiplied by the number of employees the CCPC employed in that province for that year. To qualify, eligible CCPCs must file their tax return for their 2023 tax year by July 15, 2024, to be entitled for the rebate pertaining to the 2019−2023 fuel charge years.

Clean Electricity Investment Tax Credit

Additional details for this tax credit, previously announced in Budget 2023, have been included in this year’s Budget. The tax credit will be available to Canadian corporations including provincial, Crown, and municipally owned corporations, as well as corporations owned by Indigenous communities and pensions. This measure will provide a 5−15% investment tax credit on the purchase of equipment that generates electricity from sources such as solar, wind, water, nuclear and geothermal, as well as certain refurbishments and transmission equipment. This tax credit will generally apply to new purchases that become available for use on or after April 16, 2024, and before 2035, provided no part of the project construction started before March 28, 2023.

Other Notable Initiatives

There are several more mandates and measures from this Budget that we need to briefly review:

- Measures for Indigenous communities

- Investing in artificial intelligence (“AI”)

- Addressing ‘junk fees’

- Common Reporting Standards ("CRS") and Organisation for Economic Co-operation and Development’s (“OECD”) Crypto-Asset Reporting Framework

- Mutual fund corporations

- Qualified investments for registered plans

- Other personal tax measures

Measures for Indigenous Communities

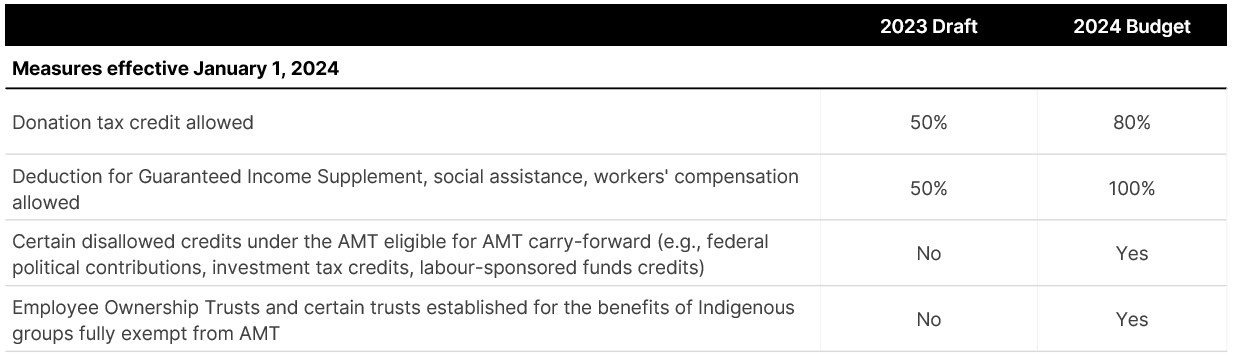

This year’s Budget introduces tax measures that impact trusts benefiting Indigenous groups, focusing on providing tax exemptions such as AMT and eligibility for the Clean Electricity Credit, both subject to specific conditions, and amendments to the First Nations’ Goods and Services Tax Act. Other measures are designed to support Indigenous groups by recognizing the unique status and rights of these communities within Canada's constitutional framework. This approach includes funding to advance Indigenous self-determination and governance development, addressing the legacy of residential schools, and promoting economic reconciliation. Additionally, the Budget touches on improving health, housing, infrastructure, and food security in Indigenous communities.

Investing in AI

In addition to the Budget funding major research and science infrastructure investments, the Federal Government is making significant investments in AI. These include $2 billion to launch a new AI Compute Access Fund and Canadian AI Sovereign Compute Strategy to help Canadian researchers, start-ups, and scale-up businesses access the computational power to drive the development of Canadian-owned AI infrastructure, as well as creating an AI Safety Institute of Canada to ensure this AI development is done safely.

Addressing ‘Junk Fees’

This Budget proposes that the Federal Government and provinces and territories will work to target and reduce ‘junk fees,’ which include hidden or unexpected charges that consumers face, such as excessive banking fees, airline baggage fees, and cancellation fees. The Federal Government aims to work with provinces and territories to modernize laws to prohibit misleading fees, investigate high international roaming fees, reduce telecom prices, and provide stronger protections against concert ticket vendors’ excess fees and predatory reseller practices. The government is taking steps to modernize the Competition Act, improve competition in the telecom space, and engage the Consumer Bureau.

Common Reporting Standards and Organisation for Economic Co-operation and Development’s Crypto-Asset Reporting Framework

The Budget proposes integrating the OECD's Crypto-Asset Reporting Framework into Canada's reporting requirements for crypto assets. This is part of a broader initiative to address the changing nature of financial markets, particularly the emergence of crypto assets. This is a significant expansion of the information exchange and reporting mechanisms currently in place for financial accounts under the CRS, which is geared to increase compliance with respect to the taxation of these assets in line with global efforts to prevent tax evasion. Once implemented, businesses in Canada that deal with crypto-assets, such as exchanges, will need to report detailed information about these transactions to the CRA. This integration is aimed to be implemented in 2026, with the reporting requirements to begin in 2027.

Mutual Fund Corporations

Specific amendments to the Income Tax Act are proposed in the Budget to prevent certain corporations from qualifying as a mutual fund corporation where it is controlled by, or for the benefit of, a group that does not deal at arm’s length. Mutual Fund Corporations enjoy preferential tax rules, such as allowing capital gains realized by the mutual fund corporation to the treated as capital gains realized by its investors. The government wishes to ensure these benefits apply only to corporations that are “widely held” by the public, and not those which are controlled by a small group. This measure would apply to taxation years that begin after 2024.

Qualified Investments for Registered Plans

This year’s Budget is seeking input from stakeholders in the asset management industry, regarding the modernization and harmonization of the definition of qualified investments for registered plans (RRSPs, RRIFs, TFSA, RESPs, RDSPs, FHSAs and DPSPs). The current definition of qualified investments is rather limited and includes assets such as publicly traded securities, mutual funds, GICs, and certain bonds. Presently, these plans have slightly varying definitions of qualified investments, and the Federal Government is considering several changes, including how to promote Canadian-based investments, whether crypto assets should be included as qualified investments, and how to simplify the inclusion of investments in small businesses in registered plans. Stakeholders can submit their comments by July 15, 2024.

Other Personal Tax Measures

This Budget proposes to extend the Canada Child Benefit for six months after a child's death, starting in January 2025, to help financially support grieving families. The Budget also proposes the creation of a National School Food Program and more funding to create additional affordable childcare spaces, and proposes enhancements to the list of expenses recognized for the Disability Supports Deduction to better acknowledge the broad range of supports needed for those individuals’ success in various aspects of their lives.