Regional Variations in the Housing Market

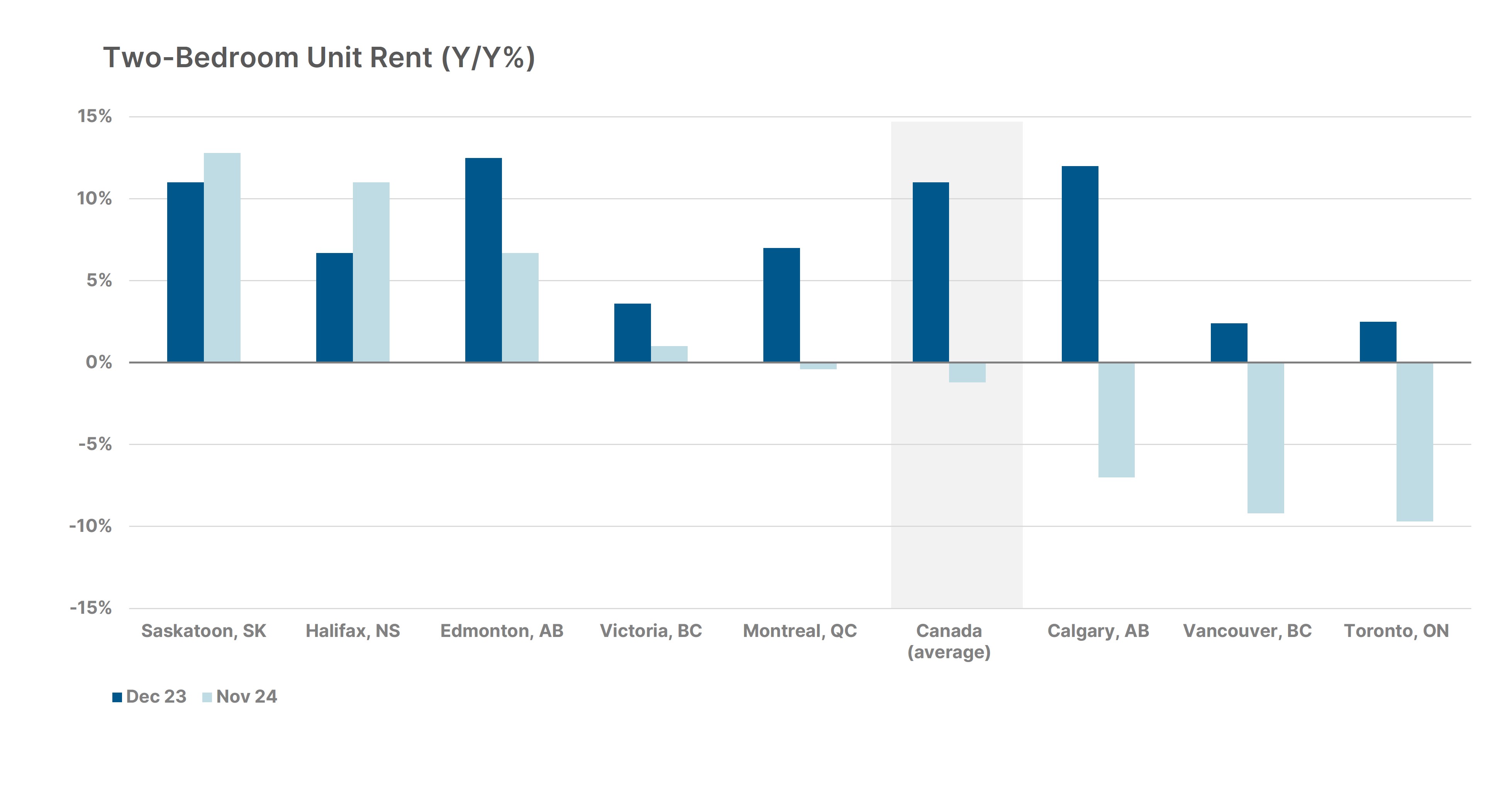

Canada’s housing market is highly regional, with significant differences in performance between cities and provinces. In places like Toronto and Vancouver, home prices have stagnated, and rental growth has slowed. Meanwhile, cities in Alberta, particularly Calgary and Edmonton, have experienced more stability, with more affordable prices and steady demand. These regional dynamics can affect the returns on investment, making it critical for investors to tailor their strategies to specific markets.

Regional trends are important to consider when investing in Canadian real estate. For example, Toronto and Vancouver are seeing stagnation in home prices and slowing rental growth, while cities like Calgary and Edmonton continue to offer more affordable housing with steadier price trends. Investors should look beyond national trends and evaluate specific markets to optimize returns.

Strategic Considerations for Investors

In this evolving market, a strategic approach is essential for investors seeking to navigate new challenges. Below are some key considerations:

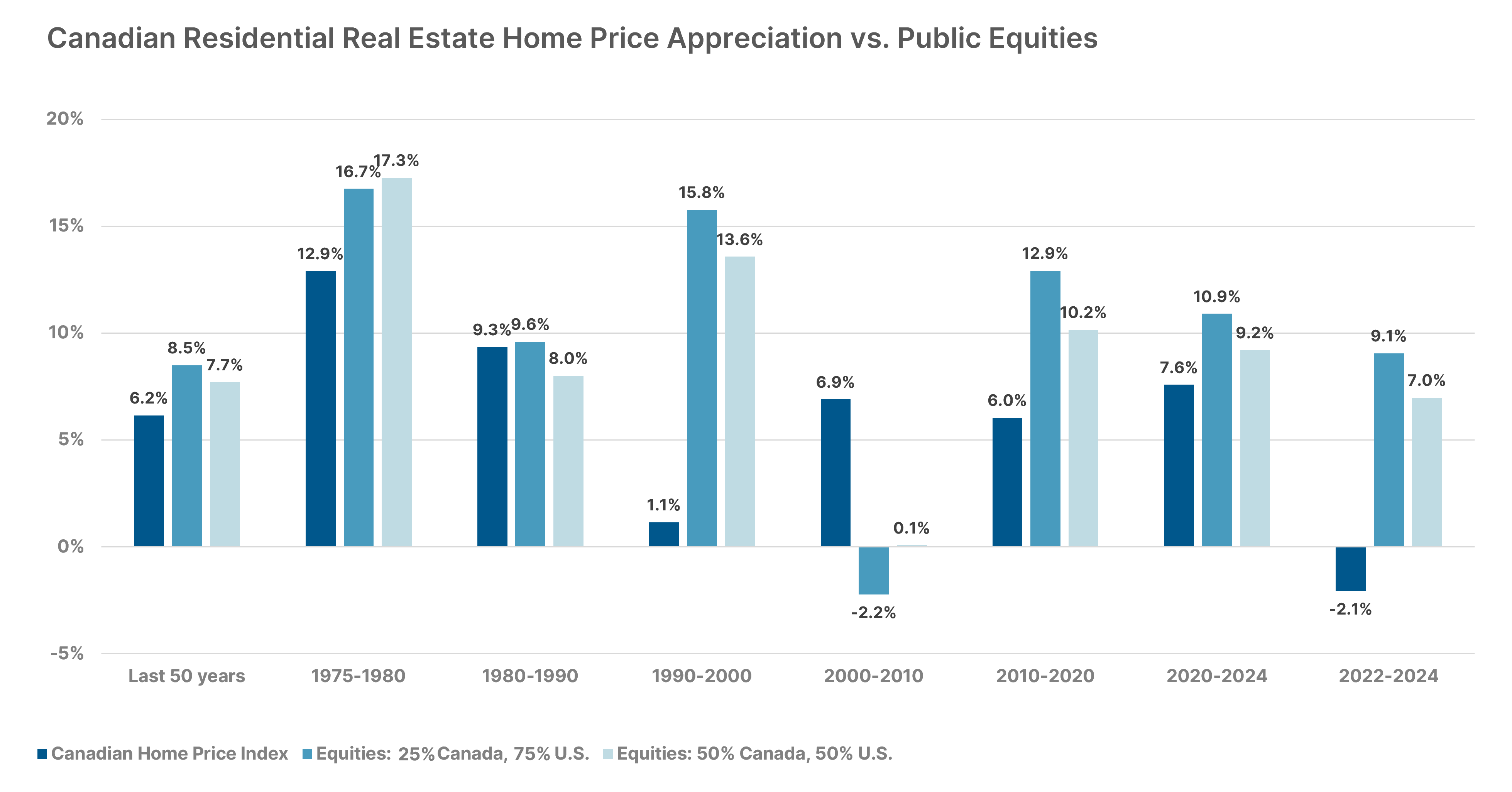

- Reevaluate return expectations: Investors should prepare for lower returns, particularly in markets with slowing rental growth and higher borrowing costs.

- Diversify across asset classes: A balanced portfolio that includes equities, bonds, and other asset classes can reduce concentration risk and improve resilience. For investors with sizeable investment portfolios in residential real estate, consider diversification across property types, and regions to further reduce idiosyncratic risk.

- Plan for scenario variability: Assess investments under different economic scenarios to understand risks and rewards.

- Consult trusted advisors: Engage financial and tax advisors to optimize strategies and manage leverage effectively.

- Extend investment horizons: Compared to previous housing market cycles, short-term opportunities for profits may be fewer and far between, so long-term thinking is essential going forward.

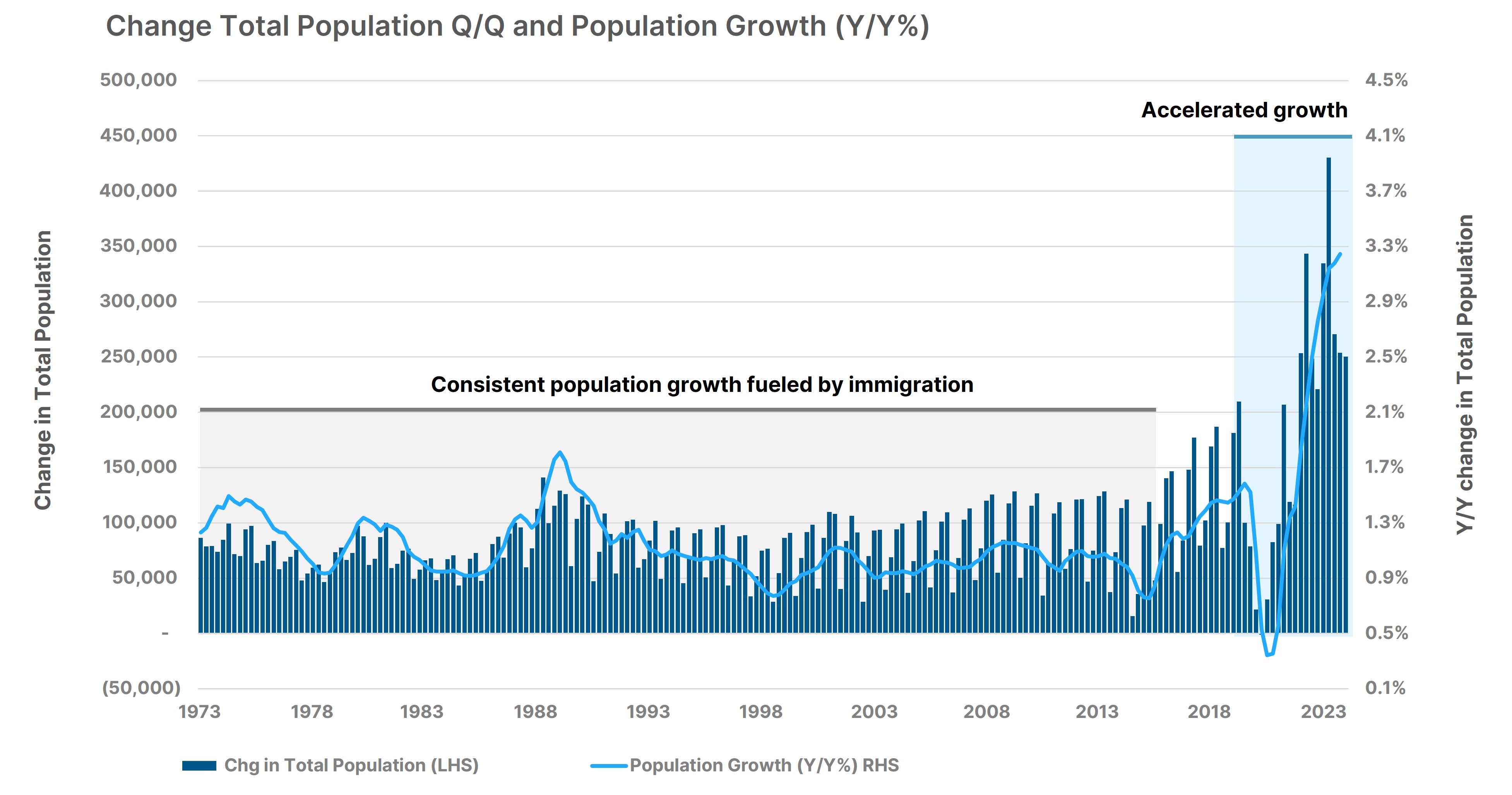

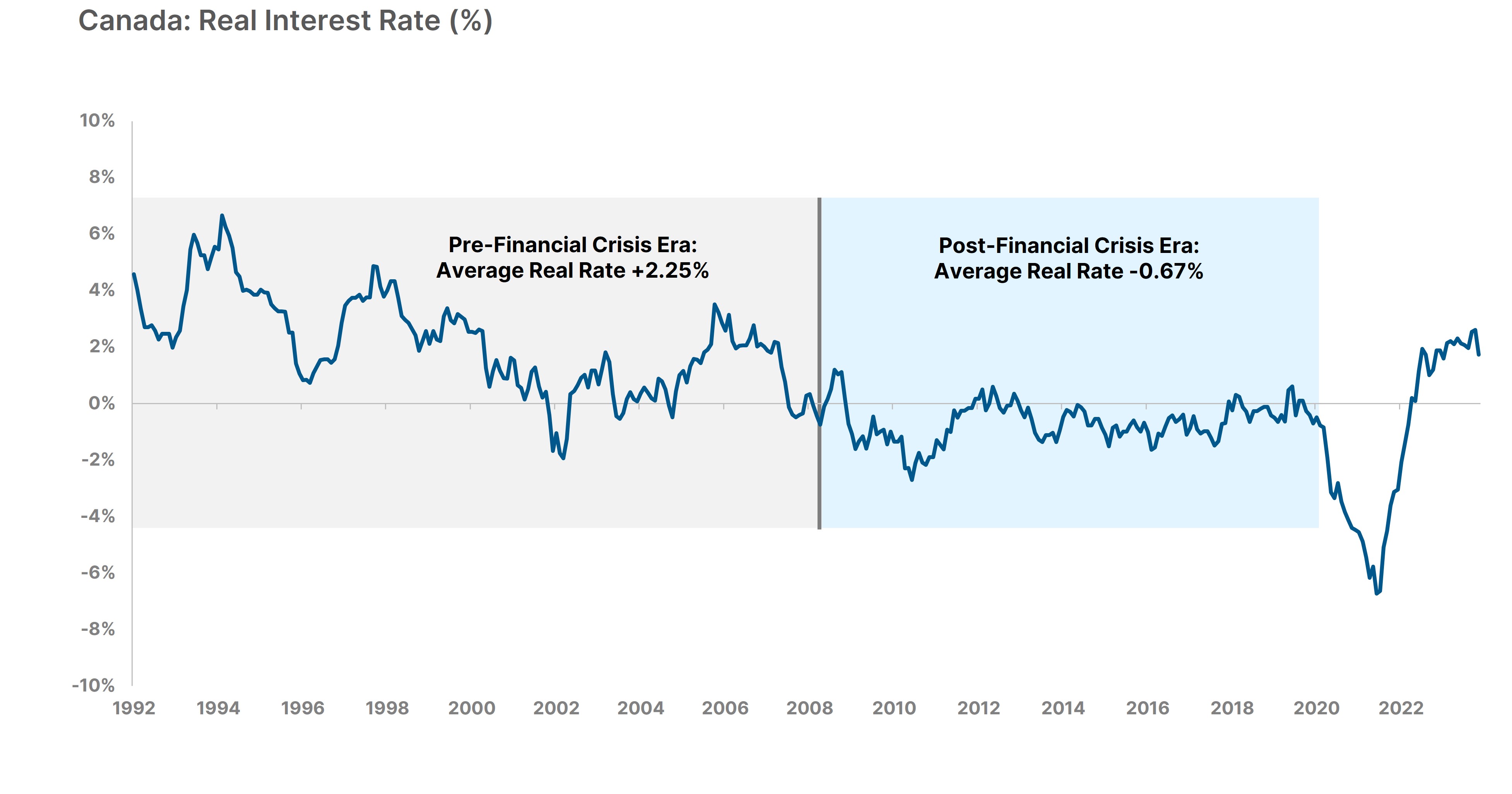

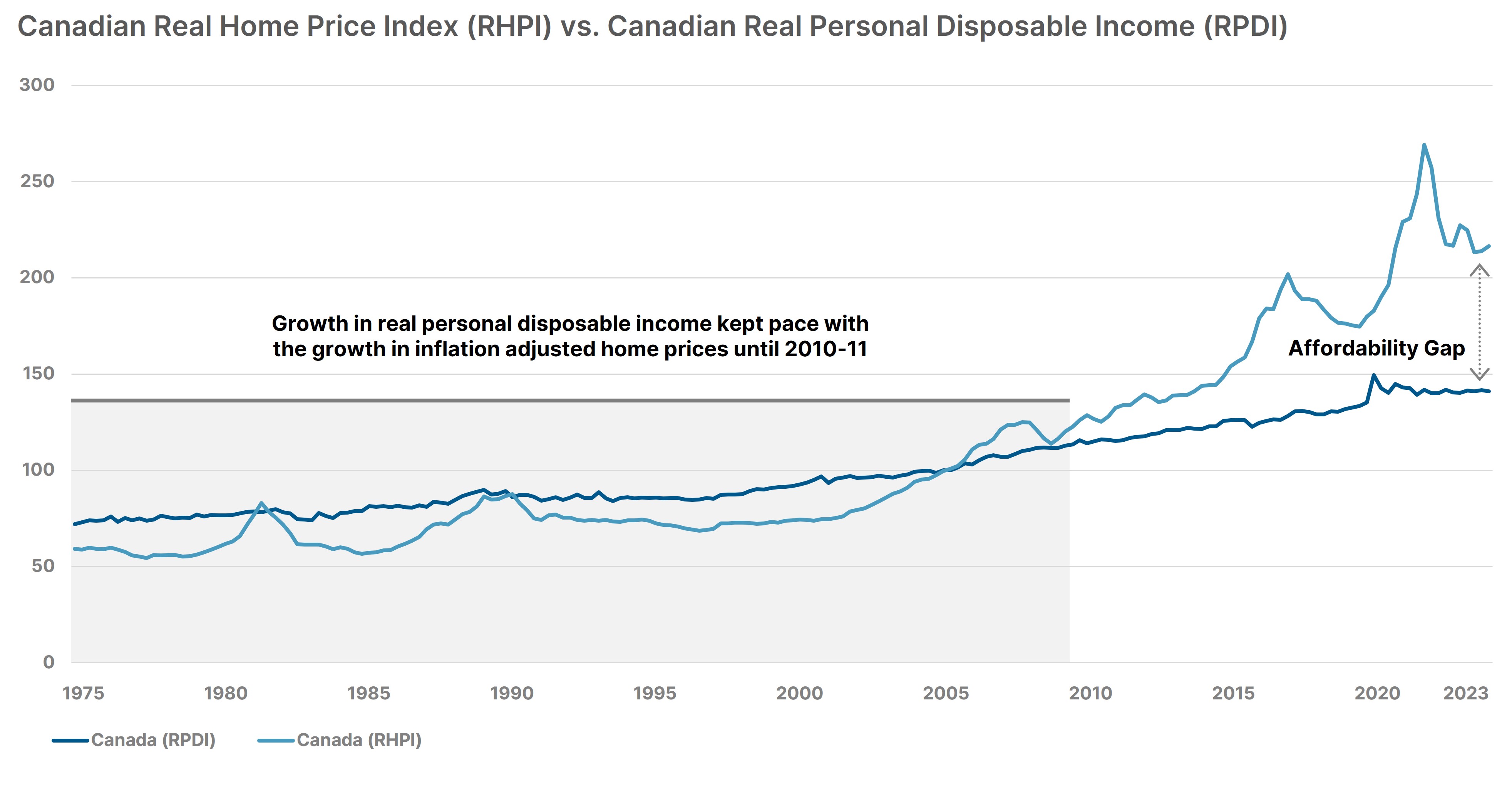

Canadian residential real estate remains a vital component of wealth-building strategies, but the market’s evolution demands a more nuanced approach. The factors that previously drove extraordinary returns—such as low interest rates, strong population growth, and constrained supply—are shifting, and investors must adapt their strategies to align with this new reality.