Denika Heaton, BBA, JD, TEP, CEA Tax and Estate Planning Specialist, Private Wealth

Chris Hanley, CPA, CA, CFP Tax and Estate Planning Specialist, Private Wealth

Key Takeaways:

- Incorporation can provide significant tax advantages through lower corporate rates, income deferral, and capital gains exemptions

- Corporate structures can offer liability protection for personal assets and flexible compensation options

- Business owners may access enhanced estate planning strategies and business succession opportunities

- Added complexity and costs (initial and ongoing) should be carefully evaluated against potential benefits

For successful business owners, the question isn’t whether incorporation offers advantages; it’s whether those advantages justify the added complexity for your specific situation. The decision often hinges on factors like annual income levels, growth trajectory, exit planning timeline, and family wealth transfer goals.

Beyond the basic legal step of registering a company, incorporation fundamentally changes how your business income is taxed, how liability is managed and what strategic options become available for long-term wealth building. This article covers the fundamentals of setting up a private corporation in Canada, exploring the primary reasons business owners choose this structure, and introducing key concepts that will be examined in greater detail in future articles.

What Does Incorporation Actually Mean?

Incorporation creates a new legal entity that exists separately from its owners (shareholders). This distinct corporation can own property, enter into contracts, borrow money, be liable for the corporation’s activities, and file taxes independently as a separate and distinct taxpayer.

The incorporation process involves several legal and administrative steps. These include selecting a jurisdiction (such as federal or provincial incorporation), preparing articles of incorporation, issuing shares, and appointing directors, among others. For existing businesses operating as sole proprietorships (i.e., a business owned and operated by a single individual without a separate legal entity) or partnerships, additional steps are required to transfer the business to the new corporation. While you can handle most of these steps independently, having a legal and tax professional guide the process is generally advisable to ensure proper execution.

Once established, a corporation exists indefinitely, continuing even if business operations cease or shareholders pass away, until legally dissolved or combined with another corporation.

Once incorporated, your business will face ongoing reporting and compliance obligations requirements including annual filings, corporate record maintenance, and tax compliance. These additional costs, complexities, and administrative responsibilities should be carefully weighed against the potential benefits of incorporation.

Why Incorporate My Business?

The decision to incorporate typically centers on several key advantages: tax benefits, liability protection, greater flexibility for structuring ownership (including bringing in business partners and raising capital), and creating a framework that is often more attractive to potential future purchasers of the business. Each offers compelling benefits for the right business situation.

Tax Advantages of Incorporation

Lower Tax Rates on Business Income

One of the primary reasons business owners consider incorporation is the potential for tax savings. Canadian-controlled private corporations (CCPCs) benefit from lower tax rates on active business income compared to personal income tax rates, largely due to the small business deduction that applies to the first $500,000 of active business income each year. This preferential rate significantly reduces the corporate tax burden, allowing incorporated businesses to retain more after-tax earnings for reinvestment or other purposes.

Consider this example:

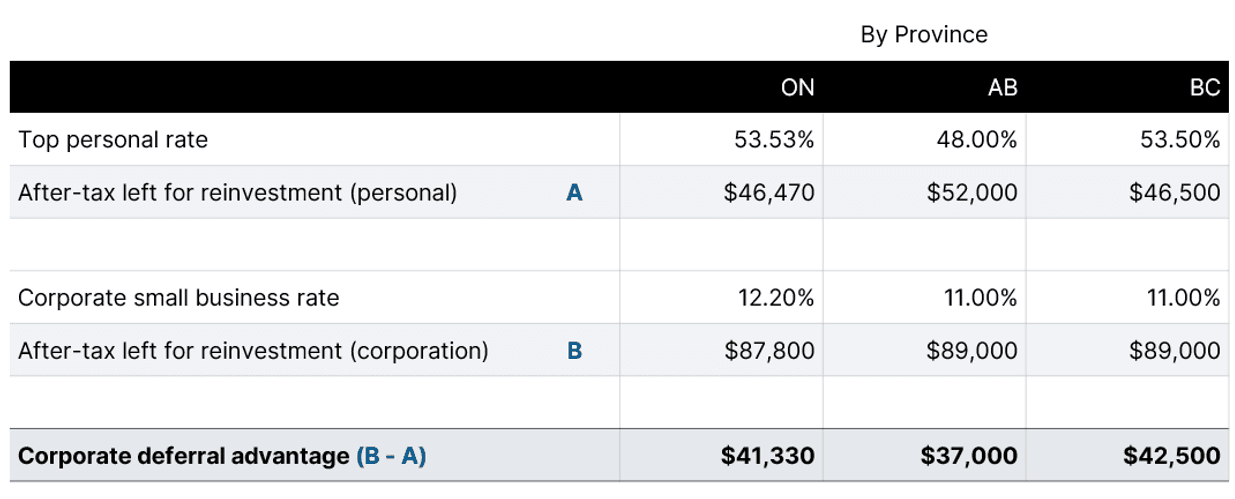

A business earns $100,000 in pre-tax income from carrying on business primarily in Canada. They want to grow the business, so the after-tax income will be reinvested. The table below compares how much remains available for reinvestment under personal taxation (at the top marginal rate) versus corporate taxation by province.

Note: The personal and corporate tax rates shown reflect combined federal and provincial rates. Tax information sourced from the Canada Revenue Agency as of October 2025

As the table shows, earning this income through a corporation rather than personally results in significantly more after-tax funds available for reinvestment — over $40,000 additional in some provinces. Even for those not in the top personal tax bracket, meaningful gaps typically exist between personal and corporate tax rates on active business income.

When funds aren’t required for operations, retained earnings can be invested within the corporation to accumulate retirement investments. Personal tax will be payable upon withdrawal, so the benefit is primarily tax deferral. Future articles will explore corporate investment strategies and retirement income withdrawals, including when this may result in overall tax savings.

Flexibility In Compensation

Corporations offer flexibility in how you pay yourself. Incorporated business owners can optimize their tax situation by choosing a salary, dividends, or a combination of both, depending on annual needs and tax planning objectives. Since your needs may change from year to year, it is advisable to consult with a tax advisor annually to optimize your corporate withdrawal strategy.

Potential Income Splitting Opportunities

While sole proprietors can pay reasonable salaries to family members who work in the business, corporations offer additional income splitting opportunities through dividend distributions to family shareholders (directly or through a trust). However, the Tax on Split Income (TOSI) rules have significantly restricted these strategies, particularly when family members are not actively involved in the business. Given the complexity of these tax rules, careful planning with a tax advisor is recommended to ensure compliance with these rules.

Tax Savings When Selling Your Business

For business owners who anticipate selling their business in the future, incorporation provides access to the Lifetime Capital Gains Exemption (LCGE). The LCGE allows each individual shareholder to shelter up to $1.25 million of capital gains from tax on qualifying CCPC share sales (2025 amount, indexed to inflation from 2026).

For top-rate taxpayers, this translates into tax savings of approximately $334,000 in Ontario or British Columbia, or $300,000 in Alberta. Since the exemption applies per individual, multiple family shareholders (directly or through a trust) may be able to multiply these potential tax savings through proper planning.

Approximate tax savings calculated by applying the top combined federal–provincial marginal capital gains tax rate in each province to the $1.25 million LCGE limit. Tax information sourced from the Canada Revenue Agency as of October 2025

Tax-efficient Funding of Non-deductible Expenses

Corporations can more efficiently fund certain non-deductible business expenses, such as the non-deductible portion of meals and entertainment (50% limitation) or non-deductible life insurance premiums. Paying these expenses with after-tax corporate dollars (taxed at lower corporate rates) rather than after-tax personal dollars reduces overall tax costs.

This approach can result in meaningful tax savings over time, particularly for owners in higher personal tax brackets, as less pre-tax income is needed to cover identical expenses.

Important Considerations for Start-ups

Corporate losses cannot offset personal income from other sources; they remain “trapped” within the corporation and may only be applied against future corporate profits. For entrepreneurs expecting significant start-up losses, this limitation delays tax benefits until profitability, making it an essential factor when deciding to incorporate early on.

Enhanced Business Flexibility

Partnership and Investment Opportunities

Incorporation provides greater flexibility for structuring ownership and bringing in business partners. Different classes of shares allow you to customize voting rights, dividend entitlements, and future growth participation for founders, investors, or employee-owners. This structure makes it easier to attract and retain key talent through employee share ownership plans or to accommodate new partners or investors as your business grows.

Liability Protection

The separate legal entity structure helps protect personal and other corporate assets from creditors. This protection can be particularly valuable for corporations holding higher-risk assets (such as commercial real estate) or operating in industries where litigation is more common (oil and gas exploration, recreation facilities, and manufacturing). Adequate insurance remains essential for managing inherent business risks.

Important limitations exist: personal guarantees of corporate obligations eliminate this protection, and shareholder-directors remain personally liable for specific corporate obligations, including environmental damage, unpaid wages or taxes, and payroll remittances if the corporation defaults.

Professional corporations (such as those used by lawyers, accountants, healthcare professionals, or other practitioners) don’t protect against personal liability from professional negligence or misconduct.

Estate Planning Opportunities

Incorporation opens the door to a range of estate planning strategies. For example, you can "freeze" the value of your shares and pass future growth to the next generation, use a trust to manage the business on behalf of beneficiaries, or establish a separate holding company to transfer excess assets on a tax-deferred basis for retirement, succession planning, and creditor protection. These approaches can help preserve family wealth and ensure a smooth transition of the business, whether within the family or to outside parties.

Important Limitations and Challenges

Incorporation significantly increases complexity and costs compared to a sole proprietorship. Beyond initial setup and share issuance, you must maintain the separate legal entity, which involves annual corporate registry filings, keeping up-to-date corporate records, and managing a distinct set of bookkeeping and tax filings. Compliance requirements can be significant, and the administrative burden often increases as the business grows.

If your corporation has multiple shareholders, a shareholders' agreement is usually recommended to address governance and succession issues, adding another layer of legal and planning work.

Estate planning also becomes more involved, as incorporating means you should revisit your Will and Power of Attorney for property, and may need to reconsider who is best suited to act as your executor or substitute decision maker, given the added complexity of the corporation.

These additional costs and complexities should be weighed carefully against the potential benefits of incorporation.

Making the Right Decision

Incorporation offers various benefits for Canadian business owners, from tax planning opportunities and liability protection to additional flexibility with your estate planning options. However, these advantages come with increased costs, complexity, and certain limitations that require careful evaluation.

Whether it’s the right step for you depends on your business’s unique circumstances and your long-term family goals. Each of these factors should be carefully weighed against the potential benefits.

Considering incorporation for your business?

Our Tax and Estate Planning team is here to guide you through the broader considerations of whether incorporation fits within your financial plans. We can connect you with independent legal and tax professionals who are equipped to provide tailored advice and handle the implementation. With the right team in place, you can navigate these decisions confidently and make informed choices for your business and your family's future.

Contact your Mawer Investment Counsellor to see how we can help.