Understanding Bond Investing: A Foundation for Investors

Fixed income investments play an important role in diversified portfolios, providing opportunities for income generation, capital preservation, and portfolio diversification. This article explores the basic tenets of bond investing to help build a foundation of knowledge about this essential asset class.

In our follow-up piece, Bonds in Transition: Adapting Fixed Income Strategies for Today's Volatile Markets, we'll examine how bond portfolios performed during recent market challenges and provide strategies for navigating changing economic conditions.

The Role of Fixed Income in Portfolios

Fixed income can play several important roles in an investment portfolio, though the specific allocation will vary based on each client's unique situation. For many investors, bonds provide some combination of steady income, capital preservation, and diversification against stock market volatility. Think of bonds as the reliable foundation of a well-constructed financial house—not as eye-catching as the decorative elements, perhaps, but providing stability to the overall structure.

(For a deeper exploration of how these traditional roles have been tested in recent market conditions, see our companion article Bonds in Transition.)

What Exactly Is a Bond?

Before diving into today's complex market environment, let's establish a clear understanding of what a bond actually is.

At its core, a bond is a debt security that represents a loan. When you purchase a bond, you're lending money to the issuer—whether that's a government, municipality, or corporation for a defined period of time. In return, the issuer promises two things:

- Regular interest payments (called "coupons")

- Return of your principal investment when the bond matures

For example, if you purchase a $1,000 bond with a 4% coupon rate and a 5-year maturity:

- You'll receive $40 per year in interest ($1,000 × 4%), typically paid in two $20 installments every six months as most bonds pay interest semi-annually.

- After 5 years, you'll get your $1,000 back (the “loan” is repaid)

This contractual arrangement provides the predictability that makes bonds valuable, but also creates vulnerabilities in certain economic environments, particularly during periods of rising interest rates or inflation. We'll explore these risks in more detail later in this article.

Bond Basics: How Pricing Works

Bonds trade in the secondary market at prices that can fluctuate above or below their face value:

- Par (100): The bond trades at exactly its face value ($1,000 for a $1,000 bond)

- Premium (>100): The bond trades above its face value ($1,050 for a $1,000 bond)

- Discount (<100): The bond trades below its face value ($950 for a $1,000 bond)

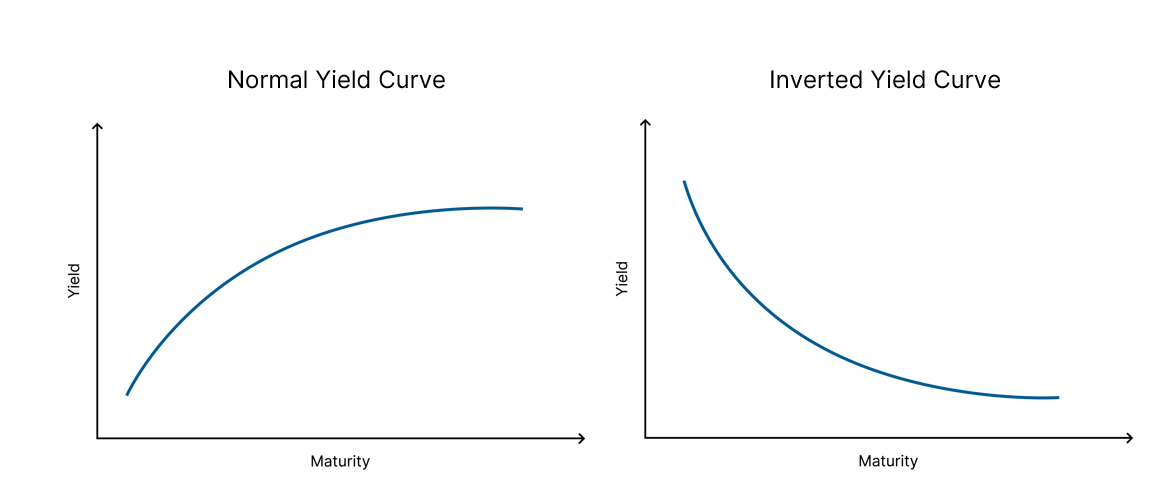

When interest rates rise, the prices of existing bonds typically fall. When rates fall, bond prices typically rise. This inverse relationship is fundamental to understanding bond market behaviour.

Why does this happen? A bond's price reflects the value of the income it provides through regular coupon payments. When prevailing interest rates fall, existing bonds with higher coupon rates become more attractive because they pay more income than newly issued bonds. Investors are willing to pay a premium for these higher-yielding bonds. Conversely, when interest rates rise, existing bonds with lower coupon rates become less attractive compared to new issues paying higher rates, causing their prices to fall and trade at a discount.

Key Risks Every Bond Investor Should Understand

Understanding the specific risks in fixed income investing is essential for building resilient portfolios:

Inflation Risk

Inflation erodes the purchasing power of fixed interest payments. When inflation rises, bonds with fixed coupons become less attractive because those payments buy fewer goods and services.

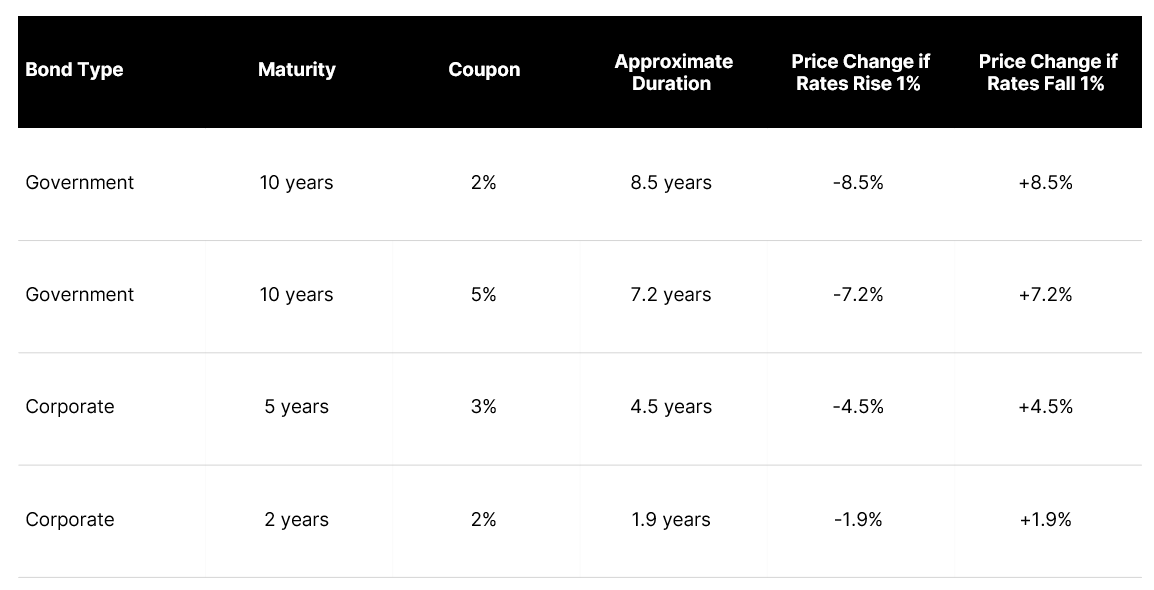

Interest Rate Risk

When interest rates rise, existing bonds with lower coupons become less valuable compared to newly issued bonds offering higher rates. This inverse relationship between rates and prices is a fundamental principle of bond investing.

Understanding these risks isn't merely theoretical—they materialized significantly during the market volatility of 2022, when both bonds and equities declined simultaneously. Our companion article explores how these risks manifested in real market conditions and offers strategies for addressing them.