Chris Hanley, CA, CPA, CFP® and Denika Heaton, BBA, JD, TEP

Mawer Tax and Estate Planning Specialists

In this case study, we’ll explore a common situation for cottage owners: how the principal residence exemption (“PRE”) can reduce income taxes for a family with multiple properties.

The PRE currently has no dollar limit, making it possible to shelter significant capital gains. As you’ll see, understanding how the PRE operates and carefully choosing how to use it can have a significant impact on the taxes you pay and your family’s overall wealth.

Please keep in mind the following scenario is intended to be general in nature as the rules are complex and each individual situation warrants a deeper review with a qualified tax advisor.

Meet the McDonald Family

Maureen and Mark McDonald are married retirees in their mid-60s who discovered their passion for world travel later in life. Now, they can be found frequently jet setting from their home in Calgary to far-flung destinations around the globe.

Their adult children, John and Michelle, have long since moved away from Calgary and established careers and families in Toronto and San Francisco.

When the kids were younger, the McDonald family would drive nearly every weekend from Calgary to their cabin in Fernie to ski, hike, and spend quality time together. However, with John and Michelle’s busy lives far away and Maureen and Mark’s travel-filled calendar, it’s been quite a few years since any of them have spent much time there.

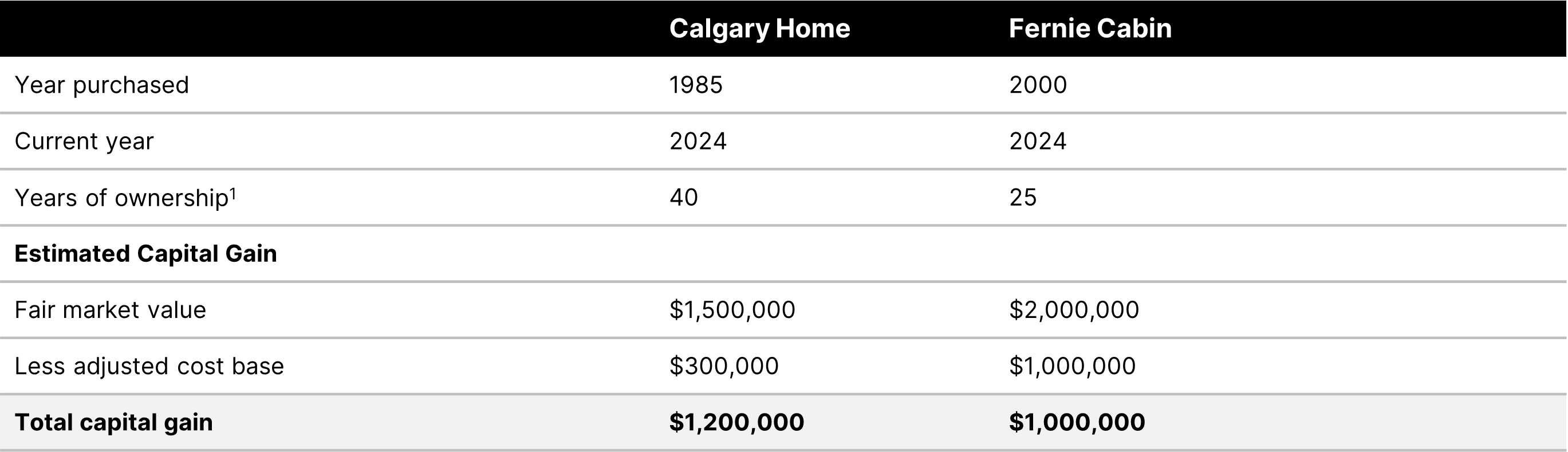

The rapidly aging property now requires increasingly expensive maintenance and is becoming more of a financial burden. After a tough family discussion, Mark and Maureen decide to sell the Fernie property. They plan to keep their home in Calgary, which they’re not likely to sell for the foreseeable future, and wish to use the sale money from their Fernie property for travel. Below is a summary of the tax attributes of the two properties: