Denika Heaton, BBA, JD, TEP, CEA Tax and Estate Planning Specialist, Private Wealth

Chris Hanley, CPA, CA, CFP Tax and Estate Planning Specialist, Private Wealth

Once you've accepted the role of estate executor, one of your first major responsibilities may be obtaining probate—the court's official validation of the deceased's Will. While not all estates require probate, understanding when it's needed, what the process involves, and associated costs can help you navigate this crucial step efficiently. Probate fees and requirements vary significantly across provinces, and the process can introduce delays and public disclosure that many families prefer to avoid when possible. Here's what every executor needs to know about the probate process in Canada.

When is Probate Required?

You may not need probate if:

- The estate consists only of assets that bypass the estate at the time of their passing (e.g. registered accounts with beneficiaries, life insurance)

- Assets are held with a valid joint tenant with rights of survivorship, such as a surviving spouse

Probate is typically required for:

- Real estate without a valid surviving joint owner or where the presumption of resulting trust applies, such as ownership with an adult child

- Non-registered investments without a valid surviving joint owner or where the presumption of resulting trust applies, such as ownership with an adult child

Probate Fees

Probate fees vary by province:

Alberta

Currently Alberta has a reasonable flat fee for probate of $525 for estates valued over $250,000.

British Columbia

In BC, probate fees are levied on estates exceeding $25,000, at a rate of 0.6% for estates between $25,000 - $50,000 and 1.4% of the estate's value in excess of $50,000. For example, below are the estimated probate fees for two estates of different values:

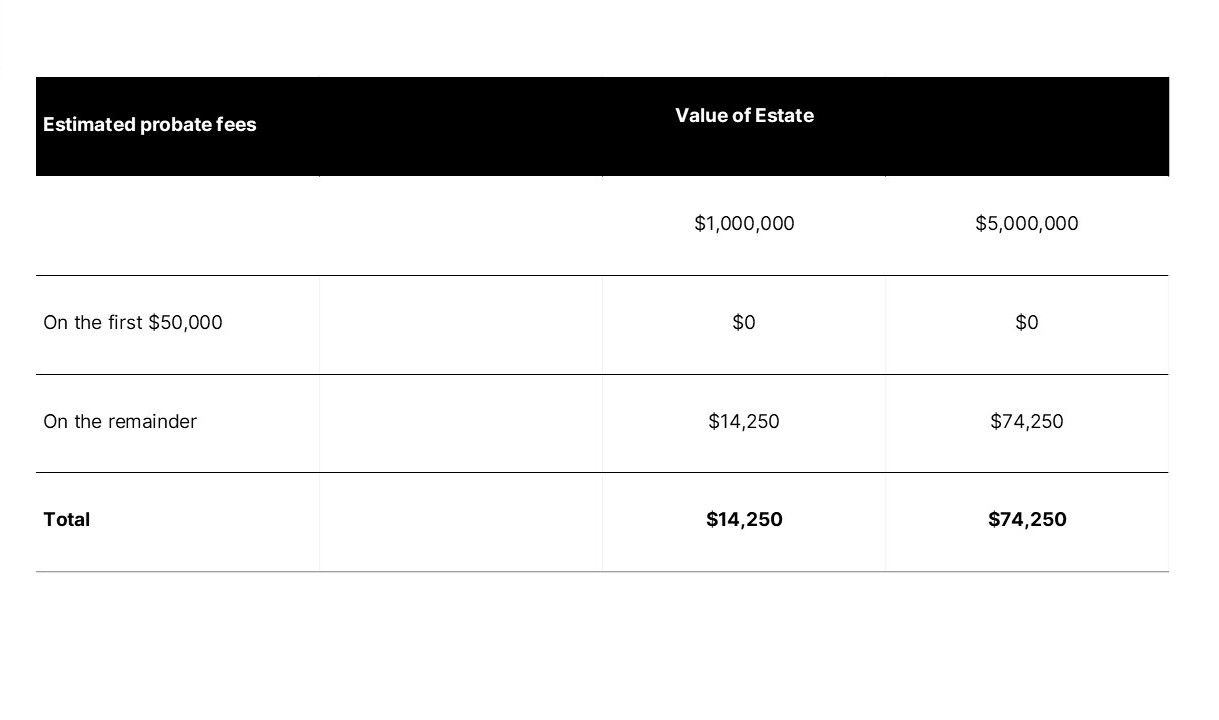

Ontario

In Ontario, estate administration tax (more commonly called "probate fees") are levied on estates exceeding $50,000, at a rate of $15 for each $1,000 (i.e. 1.5%) of the estate's value in excess of $50,000. For example, below are the estimated probate fees for two estates of different values:

The Probate Application Process

The probate application process and timeline to obtain the grant of probate vary based on the deceased's domicile or, in cases involving real property in multiple jurisdictions, the location of the property. Probate can cause significant delays and is a public process.

Typical Application Requirements

- The last original Will

- Affidavits from the Will's witnesses confirming they support the execution of the Will

- The death certificate

- A full estate inventory (assets and liabilities with fair market values at date of death), which is often included in an affidavit from the Executor

- Executor's affidavit confirming they have duly notified beneficiaries and creditors

- Applicable probate fees

Special Circumstances

When beneficiaries include minors or adults incapable of managing their affairs, additional disclosures and/or notifications to the provincial Public Guardian and Trustee may be required.

The Grant of Probate

The court-issued grant of probate serves as the executor's proof of authority to administer estate assets and fulfill the testator's wishes. Many third parties require this document before allowing access to deal with estate assets.

Important: Request both original and notarized copies of the final court orders.

Planning for the Process

Understanding the probate process helps executors plan for potential delays, costs, and administrative requirements early in the estate administration process. While probate provides important legal validation and third-party acceptance of your authority, the associated fees and public nature of the process underscore the value of proper estate planning strategies that can minimize or eliminate probate requirements. As you navigate this process, maintain detailed records of all applications and communications, and don't hesitate to seek professional guidance when dealing with complex estates or multi-jurisdictional assets.