Market Overview

Managing through uncertainty is what we do and Q3 of 2019 has proven rife with unpredictability. But this is to be expected in an environment of experimental monetary policy, negative yields/low discount rates, elevated debt levels, inverted yield curves, trade wars, and slowing global economic growth.

There were many volatile days of news headlines during the third quarter driving markets—and this seems to have become the norm. Whether it’s the loss of 5 million barrels of oil per day from the drone attack on Saudi oil infrastructure; news around Brexit with UK Prime Minister Boris Johnson losing his working majority and then the British Supreme Court ruling he unlawfully shut down parliament; or Democrats announcing an impeachment inquiry into Trump following reports he pressured Ukraine to investigate his political opponent; there seemed to be an endless barrage of bad news. Despite this, the Canadian bond market performed well and many large cap developed equity markets were positive.

While sifting through the noise, a few major factors we are paying close attention to are overall slowing global growth, slowing corporate earnings, and the potential implications from a prolonged trade war between the U.S. and China. But all of these issues presented mixed signals over Q3—in other words, it wasn’t all bad news. Moreover, central bank monetary policies and the sheer amount of negative-yielding bonds globally are helping to keep the discount rate on equities low (while the Bank of Canada was able to stand pat, the Fed cut rates twice during the quarter while other central banks around the world also eased monetary policies).

Regarding slowing global growth, the Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It signals whether market conditions are expanding, contracting, or staying the same. The Eurozone flash composite PMI for September fell to 50.4, a 6.5 year low, and in Germany, the flash composite PMI for September fell to 49.1 which is the first time in 6 years it has been below 50 (sign the country may be heading into a recession). In both cases, this was driven mainly by the manufacturing sector. And in the U.S., the September ISM Manufacturing PMI came in at 47.8 which is a 10-year low. This could be evidence that global trade tensions are finally having a meaningful impact on the U.S. itself. Although manufacturing accounts for just 11% of the U.S. economy, the concern is how this weakness may flow through to the labour market and consumer health.

Despite the prevailing downward trend of global manufacturing PMIs, there were offsetting positives. The Non-Manufacturing PMI (i.e., Services) was far more resilient. Services are driven by a healthy consumer—employment in the U.S. remained strong, wages rose, debt servicing continued to be manageable thanks to low interest rates, and overall consumer confidence was high.

And while slowing corporate earnings growth has also been a concern, this continued to be offset by the low cost to issue debt. In fact, Nestlé, became the first corporation to have a bond trade with a negative yield (i.e., zero cost debt!). The low cost of debt can translate into many positives: companies investing in projects, executing on acquisitions, buying back shares, or raising dividends. This low cost of debt should result in a lower weighted average cost of capital and ultimately into a lower discount rate on future cash flows.

Looking to the trade conflict between the U.S. and China, tensions have remained elevated with the discourse’s tone changing from one day to the next. For context around the power the trade war commentary has to affect markets, the U.S. and China make up about 40% of the global economy. When the U.S. and China export or import less it has a broad impact on other countries. A good example of this is Germany, a primarily export-focused country. As previously mentioned, the German manufacturing PMI has been under pressure in large part due to the actions and rhetoric concerning the trade war.

But once again, the news isn’t all negative. Offsets for the trade war include the interest rate cuts in the U.S. and proactive Chinese fiscal policy. And some of our holdings that have a track record of managing through difficult times are navigating the trade war conflict and performed well through the uncertainty. For example, Nike, a company heavily exposed to China, reported earnings which the market reacted positively to (revenue +7%).

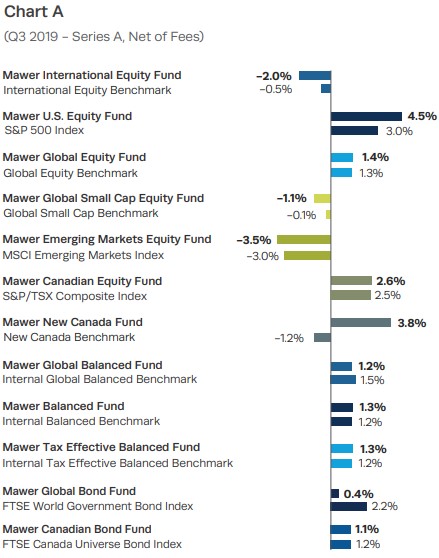

How did we do?

Performance has been presented for the A-Series Mawer Mutual Funds in Canadian dollars and calculated net of fees for the period of July 1 – September 30, 2019.