Once a digital curiosity, Bitcoin now dominates financial headlines and investor debates. Is it a new form of money, a digital commodity, or something else entirely? This article offers a practical, risk-aware framework for evaluating Bitcoin—focusing on its speculative nature, evolving market structure, regulatory shifts, and the realities of portfolio construction. The goal: to help you make informed decisions rooted in discipline and a clear understanding of what Bitcoin is—and what it isn’t.

Bitcoin and Blockchain: Technology, Hype, and Reality

Bitcoin is built on blockchain technology, an innovation that aspires to offer immutability, decentralization, and consensus-driven trust. These features have driven adoption and inspired visions of a financial system free from central authorities. Yet, removing intermediaries introduces new risks: custody, security, and theft. High-profile failures (e.g., FTX, Terra/Luna, Celsius) have exposed the fragility of centralized crypto services and regulatory gaps. Investor protection remains a central concern.

Technical barriers remain and are significant. Bitcoin transactions are slower than traditional payment systems and irreversible, complicating everyday use and error resolution. Scalability and volatility remain unresolved. Competing blockchains (e.g., Ethereum) enable programmable contracts, but real-world adoption is limited by regulatory and practical hurdles. Tokenization—digitally representing assets on a blockchain—does show promise for liquidity and cost reduction but remains mostly in pilot stages.

Regulatory Landscape: Progress and Gaps

Regulatory frameworks for digital assets are developing rapidly, driven by increased political lobbying and the desire for technological leadership. In the U.S., new legislation such as the GENIUS Act and CLARITY Act aims to clarify oversight and reserve requirements. The EU’s MiCA rules and the UK’s FCA oversight signal a global trend toward harmonization. Some countries, like El Salvador, have adopted Bitcoin as legal tender, while others experiment with small-scale holdings. Despite growing attention, large-scale, mainstream adoption remains elusive.

Adoption varies by industry. Some supply chains, land registries, and healthcare systems are experimenting with blockchain, but broad, impactful use is rare. Financial firms are exploring blockchain for payments and settlement, but progress is incremental.

Investment Framework: Speculation Versus Investment

A disciplined investment framework begins by distinguishing between investing—allocating capital to productive assets that generate cash flows—and speculation, which relies on price appreciation without underlying economic output.

Bitcoin, like gold, does not produce cash flows or dividends. Both assets derive value from scarcity, supply-demand dynamics, and the belief that others will ascribe value in the future. Gold, however, has a multi-millennial track record as a store of value and is held by central banks as part of their reserves. Bitcoin remains a relatively new and evolving asset whose value is still largely driven by narrative momentum and speculative interest. For now, both sit closer to the speculative end of the spectrum. Gold’s physical presence and established role offer a different context for its inclusion in portfolios.

The Valuation Conundrum: Why Bitcoin Defies Traditional Frameworks

Traditional valuation frameworks struggle with Bitcoin. Unlike stocks or bonds, bitcoins generate no cash flow. Some common approaches include:

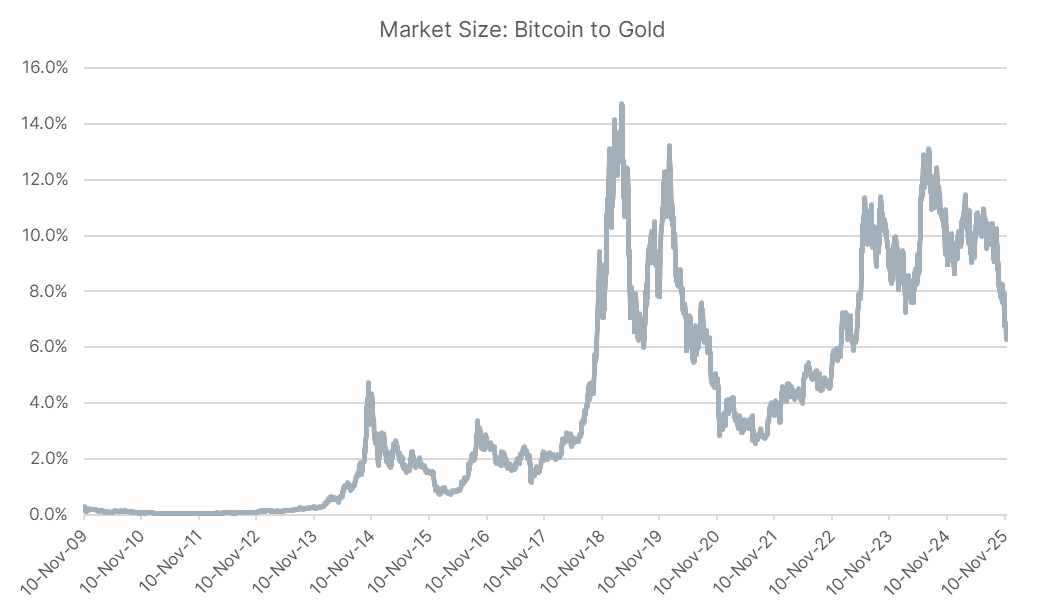

Relative value to gold: Bitcoin’s current market value is about 6.5% of gold, but there is no consensus on what the “right” ratio should be (see Chart 1). Its short history makes it difficult to assess if Bitcoin is cheap, fairly valued, or expensive versus gold. Periods of financial stress are associated with lower Bitcoin returns, while gold’s performance remains more stable regardless of market stress.

Relative value to currencies: Largely theoretical, with limited practical relevance.

Mining profitability: Mining costs can vary dramatically, limiting its use as a stable valuation anchor.

Network value: Valuation attempts based on blockchain activity and network effects have been inconsistent and unreliable.

Chart 1. Market Size of Bitcoin vs Gold in U.S. Dollars (2009-Present)

Source and notes: Bloomberg Financial LP, daily data from November 2009 to November 2025 in U.S. dollars for the Bloomberg Gold Composite and the Bloomberg Bitcoin Index which is designed to measure the performance of a single Bitcoin traded in US dollars. You cannot invest directly in an index, past performance is not an indication of future performance. Size of the gold market estimated as the spot price of gold multiplied by the outstanding gold supply in ounces. Size of the Bitcoin market estimated at the spot price of bitcoin multiplied by the total outstanding value of bitcoins mined.

Market Narratives: The Power and Limits of Story

Compelling narratives drive investment flows, and Bitcoin has some of the most powerful stories in finance. The “digital gold” narrative argues that, like gold, bitcoin is scarce and immune to debasement by governments, making it an attractive hedge against inflation and fiscal irresponsibility. With a fixed supply of 21 million coins and a transparent issuance schedule, Bitcoin appeals to those concerned about central bank policies.

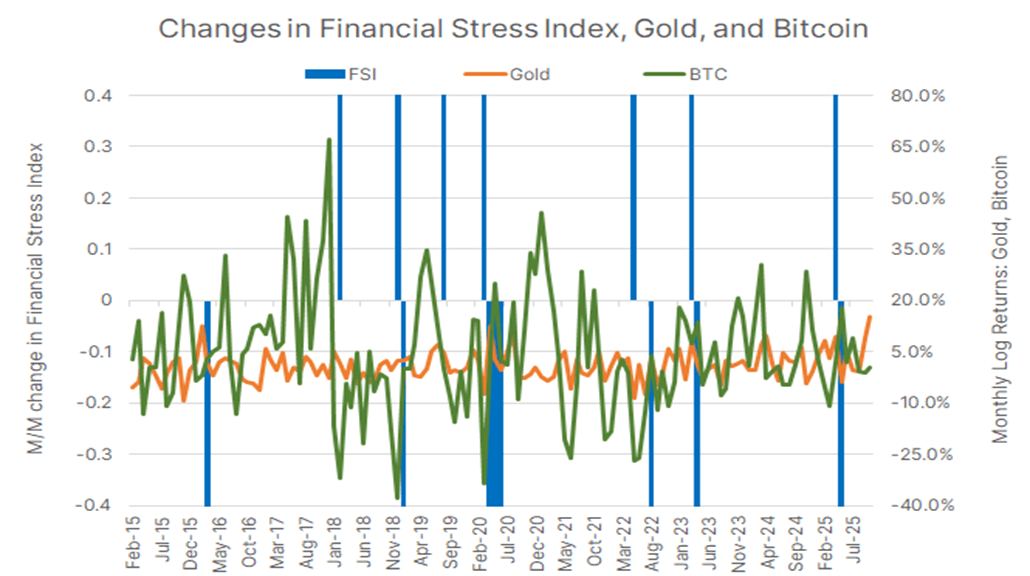

However, historical data suggests Bitcoin is not digital gold. Unlike gold, which tends to perform well during periods of uncertainty, Bitcoin has thrived in risk-on, speculative environments fueled by easy financial conditions and liquidity.

Chart 2. Bitcoin vs. Gold During Periods of Financial Stress

Source and notes: Coinbase, Coinbase Bitcoin [CBBTCUSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CBBTCUSD, November 18, 2025. Monthly data from Jan 2020 to November 2025 in U.S. dollars. Federal Reserve Bank of Cleveland, 10-Year Real Interest Rate [REAINTRATREARAT10Y], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/REAINTRATREARAT10Y, November 18, 2025. Federal Reserve Bank of St. Louis, St. Louis Fed Financial Stress Index [STLFSI4], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/STLFSI4, November 18, 2025. The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. Please refer to the disclosures section for a list of the indices used. You cannot invest directly in an index, past performance is not an indication of future performance.

Key takeaway: periods of financial stress are associated with lower Bitcoin returns, while gold’s performance remains more stable regardless of market stress.

Inflation Hedge? Evidence Remains Mixed

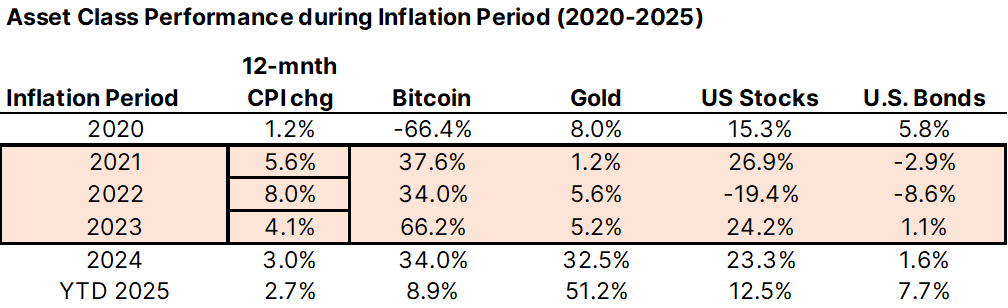

The most recent global inflationary cycle (2021–2023) was positive for Bitcoin holders, as it retained purchasing power and appreciated… provided investors held throughout the period. However, the evidence is limited and context dependent. Gold has demonstrated stronger and more consistent protection across many market cycles.

Chart 3. Performance During Inflationary Environment

Source and notes: Coinbase, Coinbase Bitcoin [CBBTCUSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CBBTCUSD, November 18, 2025. Monthly data from Jan 2020 to November 2025 in U.S. dollars. Federal Reserve Bank of Cleveland, 10-Year Real Interest Rate [REAINTRATREARAT10Y], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/REAINTRATREARAT10Y, November 18, 2025. Please refer to the disclosures section for a list of the indices used. You cannot invest directly in an index, past performance is not an indication of future performance.

Key takeaway: Bitcoin’s effectiveness as an inflation hedge depends heavily on market cycles and broader risk factors.

Risk, Return, and Correlation: The Numbers Behind the Narrative

Bitcoin’s history is marked by extraordinary gains and equally dramatic drawdowns. Its annualized volatility can reach 60-80% and far exceed those of equities and bonds. These swings are attributable to limited trading history, financial leverage, and a four-year cycle tied to “halving” events. A halving is when the reward for mining new blocks is cut in half, reducing new supply.

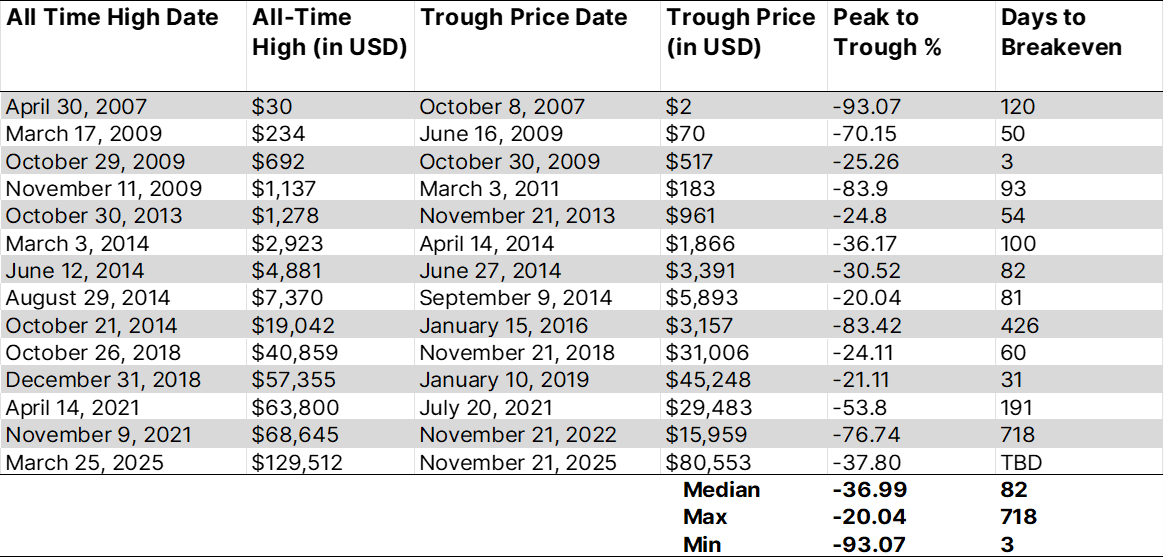

Chart 4. All-time Highs and Lows in Bitcoin (2007 to Present), in U.S. Dollars

Source and notes: Bloomberg Financial LP, daily data from April 2007 to November 2025 in U.S. dollars for the Bloomberg Bitcoin Index which is designed to measure the performance of a single Bitcoin traded in US dollars. You cannot invest directly in an index, past performance is not an indication of future performance.

Key takeaway: Bitcoin’s long-term returns have been extraordinary but so have its drawdowns and periods of breakeven.

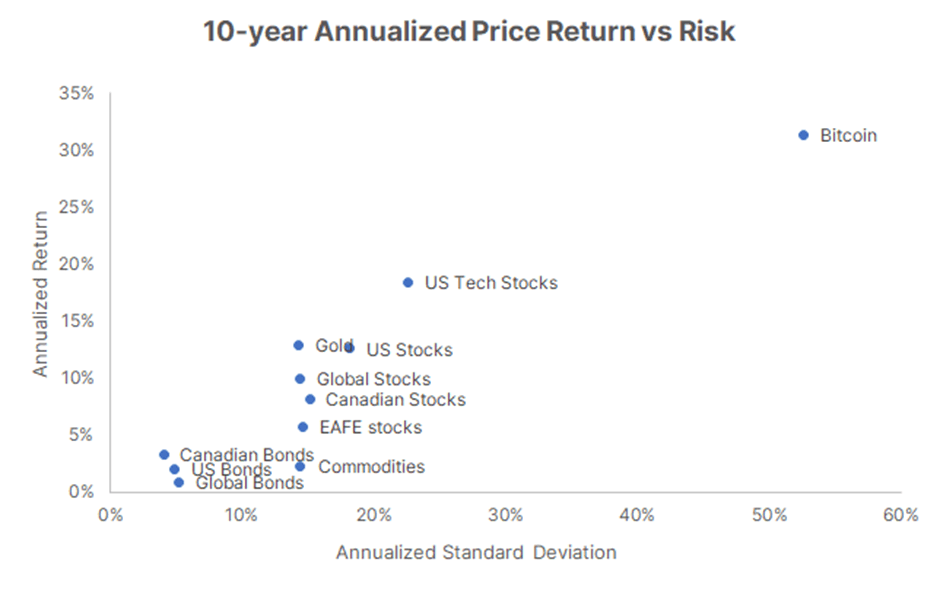

Chart 5. 10-Year Annualized Return and Risk for Different Asset Classes

Source and notes: Bloomberg Financial LP, daily data from Nov 2015 to November 2025 in U.S. dollar. Please refer to the disclosures section for a list of the indices used. You cannot invest directly in an index, past performance is not an indication of future performance.

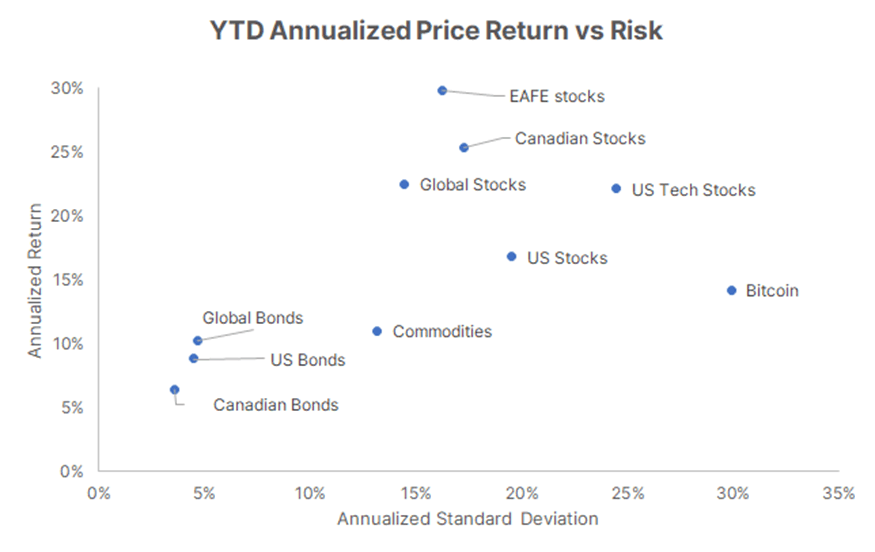

In 2025, the risk-return profile of Bitcoin has moderated, with traditional equities offering higher returns per unit of risk (see Chart 6). Recent data shows equities outperforming Bitcoin on a risk-adjusted basis.

Chart 6. Year-to-Date (YTD) Annualized Return and Risk for Different Asset Classes

Source and notes: Bloomberg Financial LP, daily data from January 2025 to November 2025 in U.S. dollar. Please refer to the disclosures section for a list of the indices used. You cannot invest directly in an index, past performance is not an indication of future performance.

Risks and Realities: What Investors Should Know

Bitcoin’s future is highly uncertain. Key risks include:

Extreme volatility: Price swings can exceed 80% in a single cycle.

Security vulnerabilities: While blockchain is robust, risks such as a “51 percent attack” (where a single entity controls most of the network’s mining power) or future quantum computing threats exist.

Energy consumption and competition: Crypto mining’s environmental impact is significant and competes with the growing AI industry for energy and infrastructure.

Correlation with risk assets: Bitcoin often rises and falls with overall market liquidity, not as a true safe haven.

Speculative nature: Returns resemble lottery outcomes more than traditional investments.

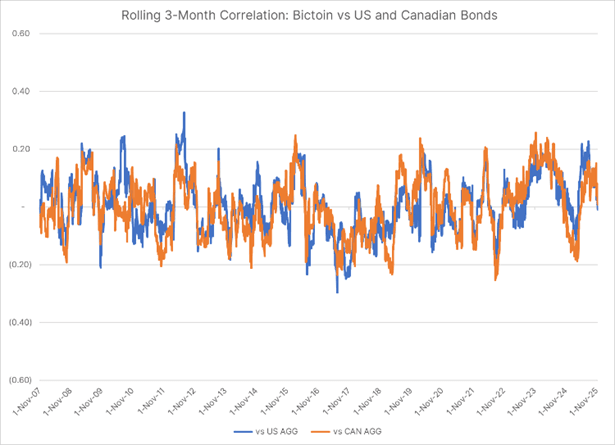

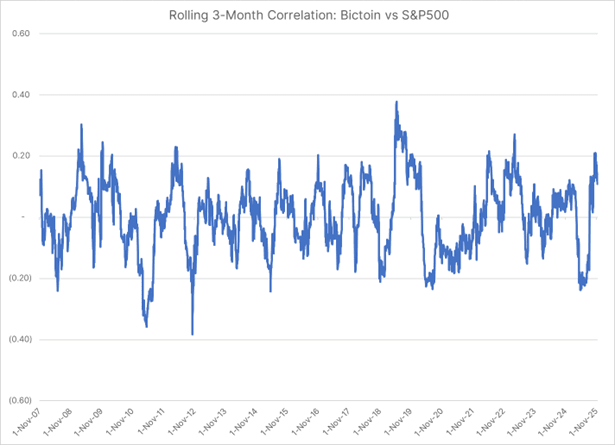

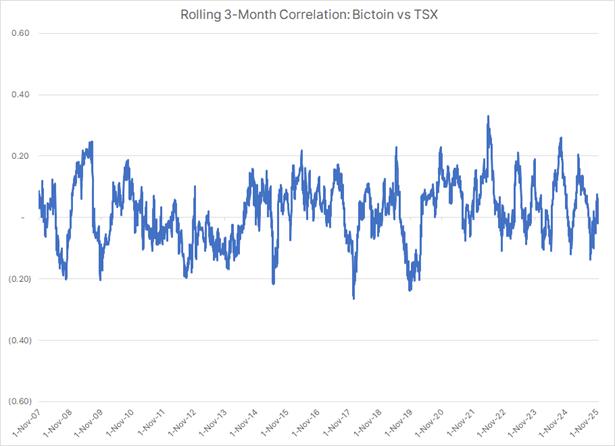

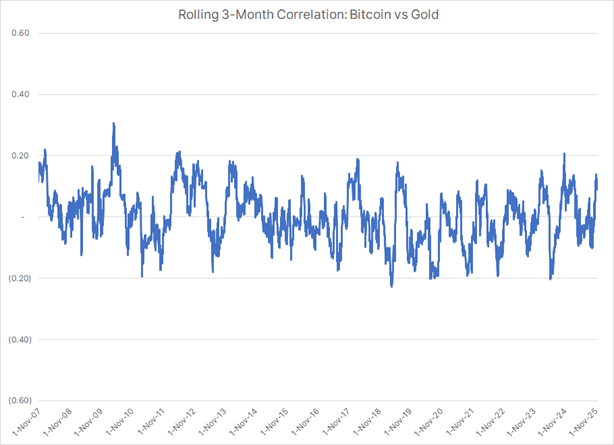

Correlations between Bitcoin, stocks, bonds, and gold have varied widely. Bitcoin shows more pronounced correlation with U.S. equities and technology stocks, and little consistent relationship with gold.

Chart 7. Asset Class Rolling Three-Month Correlation with Bitcoin (2007-2025)

Chart 8. Asset Class Rolling Three-Month Correlation with Bitcoin (2007-2025)

Chart 9. Asset Class Rolling Three-Month Correlation with Bitcoin (2007-2025)

Chart 10. Asset Class Rolling Three-Month Correlation with Bitcoin (2007-2025)

Source and notes: Bloomberg Financial LP, daily data from November 2007 to November 2025 in U.S. dollar except for Canadian Bonds and S&P/TSX Composite Index. Please refer to the disclosures section for a list of the indices used. Correlations calculated as a three-month moving average using daily data. You cannot invest directly in an index; past performance is not an indication of future performance.

Behavioral Considerations: Psychology of Bitcoin Investing

Bitcoin’s volatility triggers strong emotional responses, including fear of missing out (FOMO), overconfidence, and recency bias. Position sizes can drift above appropriate levels after rallies, adding unintended risk to portfolios. Investors should consider:

Limiting position sizes to manage emotional responses.

Expecting significant drawdowns (potentially greater than 50%) and assessing their ability to hold through volatility.

Maintaining discipline and rebalancing regularly.

Focusing on long-term perspectives, not short-term trading.

Continuously seeking out contrary viewpoints and challenging assumptions.

There is no obligation to invest in Bitcoin. Abstaining is a valid option.

Position Sizing Considerations

Individual investors may wish to note that today, most institutional investors such as pension plans and endowment funds have minimal exposure to digital assets like Bitcoin. According to State Street’s October 2025 survey[1], over half hold less than 1% in digital assets, though many plan to increase exposure. Position sizing should reflect:

Time horizon: Short-term holders potentially face heightened volatility and a real risk of losing capital; medium and long-term holders may benefit from full-cycle dynamics, but uncertainty remains high.

Total wealth: Allocations should be based on total investable assets, not just portfolio segments.

Risk tolerance: Conservative sizing is prudent given Bitcoin's speculative profile.

Conclusion: Boring Principles for a Speculative Asset

Bitcoin as an asset remains in its infancy. It may eventually earn a place in diversified portfolios or simply remain a high-volatility speculative asset, after all it’s still early days. Regulatory clarity is improving, and institutional participation seems to be evolving slowly but from a small base. Technical and market structure challenges persist.

For most investors, the boring approach prevails: skepticism, patience, and discipline. Focus on time-tested principles. Know what you own and why. Size positions for your risk tolerance and risk capacity. Diversify broadly by asset class, region, and currency. And if you’re going to invest, you should accept that bitcoin may soar or fail. Above all, manage risk first.

For many, no allocation is the right choice. For those who do invest, humility, discipline, and small position sizes are the prudent path.

[1] State Street Digital Asset Survey 2025, Regional Analysis (October 2025)

US stocks are proxied by the S&P 500 Index, representing the 500 largest publicly traded US companies. US tech stocks are represented by the Nasdaq Composite Index, which tracks a broad range of technology and growth-oriented companies. Canadian stocks are proxied by the S&P/TSX Composite Index, reflecting the Canadian equity market. Bitcoin performance is measured by the Bloomberg Bitcoin Index, designed to track the value of a single Bitcoin traded in US dollars. Gold is proxied by the Bloomberg Gold Composite, representing the spot price of gold. US bonds are represented by the Bloomberg US Aggregate Bond Index (unhedged USD), covering the US investment-grade bond market. Canadian bonds use the Bloomberg Canada Aggregate Bond Index in Canadian dollars. Global bonds are proxied by the Bloomberg Global Aggregate Bond Index (unhedged USD), covering investment-grade bonds worldwide. Commodities are represented by the Bloomberg Commodity Index (BCOM), a broad basket of commodity futures. Global stocks use the MSCI All Country World Index in local currency, capturing large and mid-cap representation across developed and emerging markets. Lastly, the MSCI EAFE Index represents large and mid-cap stocks across developed markets excluding the US and Canada.