Investors today confront the most serious Middle East crisis in decades. The Israel-Iran conflict has demonstrated how quickly regional tensions can escalate to unprecedented levels, with the potential for direct military confrontation creating ongoing market uncertainty.

For investors watching their portfolios amid headlines of nuclear facilities under attack, the critical question isn't whether markets will react—they already are. The question is: What does history teach us about navigating markets during active military conflicts?

Military Conflict Impact On Markets Through A Historical Lens

When military conflicts erupt, markets typically respond with swift repricing: energy costs surge on supply concerns, safe havens see increased demand, and broad market volatility spikes as investors reassess risk premiums. Yet historical analysis reveals important patterns about how markets have weathered similar periods of acute geopolitical stress.

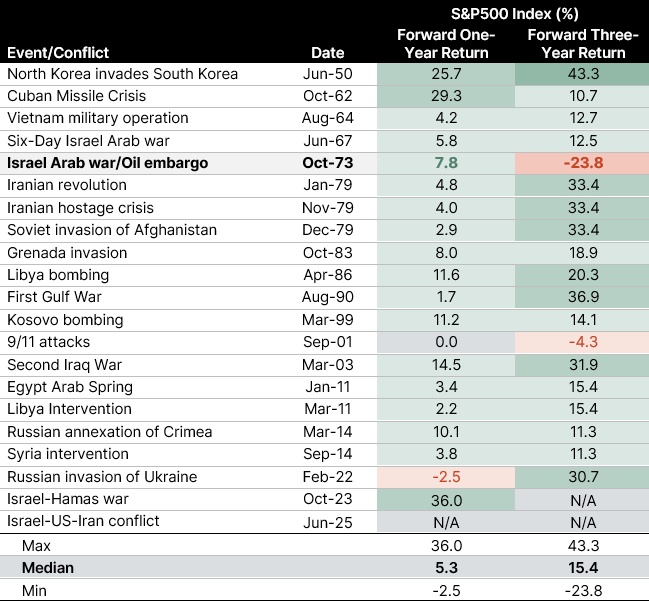

Chart 1. Historical Geopolitical Events and Market Performance

Geopolitical events create immediate volatility but often fail to produce lasting market damage.

Notes: Refinitiv, monthly data in US dollars for S&P500 Index (ex-dividends), before transaction costs, fees and taxes. Past performance is no indication of future performance.

What Really Drives Market Recovery

While geopolitical events trigger immediate market reactions, their lasting effects depend on several critical factors that often matter more than the military outcomes themselves.

Policy Response Matters

Market recovery trajectories are frequently shaped more by central bank and government responses than by the conflicts themselves. Periods of supportive monetary policy and economic expansion typically see faster market recovery than those coinciding with existing stress or tightening cycles.

Much of the immediate impact stems from uncertainty repricing, as situations clarify and the initial shock fades, markets often rebound as investors refocus on economic fundamentals.

Structural vs. Temporary Changes

Some conflicts accelerate longer-term structural trends that reshape markets over time, such as energy transition initiatives, defence spending increases, supply chain diversification, or shifts in global trade relationships. These effects may not be immediately visible in broad index returns but can fundamentally alter sector and regional leadership over extended periods.

Today’s Energy Landscape Differs

The Middle East remains central to global oil flows, with strategic waterways like the Strait of Hormuz serving as chokepoints for roughly 20 million barrels of daily transit. However, today's energy landscape has evolved dramatically from the 1970s crisis that many investors remember. Oil represents about one-third of global energy consumption today versus roughly half in the 1970s. The United States has emerged as the world's largest producer, strategic reserves have been enhanced, and OPEC's market influence—while still significant—has diminished considerably.

Navigating Active Crisis

Historical analysis suggests several key principles for navigating such periods:

Focus on Second-Order Effects: Beyond immediate market reactions, conflicts that disrupt key commodity supplies or global supply chains tend to have more lasting economic impact, affecting inflation, corporate margins, and consumer behaviour. Central bank responses often prove more influential for recovery than the conflict itself.

Quality and Liquidity Premium Increase: Companies with strong balance sheets, diversified revenue streams, and minimal exposure to affected regions tend to outperform during crisis periods.

Dispersion Creates Opportunity: Geopolitical uncertainty increases performance gaps between winners and losers across countries, sectors, and securities. This environment typically rewards investment strategies that can distinguish between temporary disruption and lasting fundamental change.

Portfolio Rebalancing Considerations: Crisis periods often create market dislocations that present both challenges and opportunities: portfolio rebalancing considerations, position sizing adjustments, and potential value opportunities from broad-based selling.

The Bottom Line

Even during active military conflicts, markets have demonstrated considerable resilience. The median 5.3% one-year forward returns following major geopolitical shocks indicate a pattern of recovery over time. Today's reduced structural vulnerabilities suggest that while energy price volatility remains likely during supply disruptions, the systemic crisis potential has been substantially mitigated compared to previous decades.

The increased dispersion and volatility that accompany geopolitical stress have historically created both challenges and opportunities, with outcomes varying significantly based on portfolio construction, risk tolerance, and investment horizons. For investors navigating these turbulent periods, history suggests that maintaining perspective on underlying economic fundamentals—while remaining alert to genuine structural shifts—often proves more valuable than reacting to daily headlines.